Home > Library

Search results : tariff

2025-07-01Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

2025-01-01The new homeland industrial policy stance tends to tilt toward substantially improving the worldwide resilience of global supply chains.

2024-07-07Central bank digital currencies (CBDC) can affect how the central bank makes macro-financial system and monetary policy decisions in support of the dual mandate of both price stability and maximum employment.

2024-02-14This ebook delves into key financial topics and stock market investment articles.

2024-01-01Western governments use the new world order of trade to achieve non-economic goals such as national security, environmental protection, labor harmonization, and technological advancement etc.

2022-09-21This ebook delves into key financial topics and stock market investment articles.

2020-06-06This ebook delves into key financial topics and stock investment memes blog posts and essays.

2020-02-02This analytic report shines fresh light on the current global economic outlook as of February 2020.

2019-08-07This analytic report shines fresh light on the current global economic outlook as of August 2019.

2020-07-26 15:29:00 Sunday ET

Firms and customers create value and wealth together by joining the continual flow of small batches of lean production to the lean consumption of cost-effec

2023-11-21 11:32:00 Tuesday ET

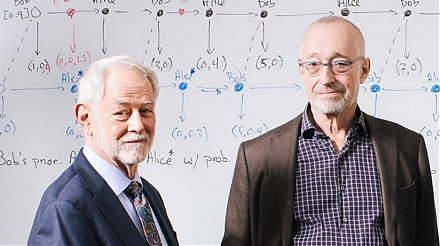

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2017-12-09 08:37:00 Saturday ET

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because i

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2017-11-29 07:42:00 Wednesday ET

The octogenarian billionaire and activist investor Carl Icahn mulls over steps to shake up the board of SandRidge Energy after the oil-and-gas company adopt

2018-08-11 14:35:00 Saturday ET

The Trump administration imposes 20%-50% tariffs on Turkish imports due to a recent spat over the detention of an American pastor, Andrew Brunson, in Turkey