Home > Library > Modern themes and insights in the economic science (Winter-Spring 2022)

Author Andy Yeh Alpha

Our fintech finbuzz analytic ebook sheds new light on the fundamental themes and insights in the modern economic science from 2000 to 2022. As of Winter-Spring 2022, this ebook provides fresh insights into the mainstream schools of economic thoughts from the neoclassical synthesis and monetarism to the New Keynesian framework and Keynesian search theory. Furthermore, this ebook focuses on the competitive advantages, opportunities, risks, and threats etc of both tech titans and megabanks in the modern age of digital tech proliferation. Fresh opportunities arise in the broader context of Internet search, consumer technology, e-communication, social media, software, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of both tech titans and banks as several regulatory institutions mistrust these corporations in global economic history.

Description:

Our fintech finbuzz analytic ebook sheds new light on the fundamental themes and insights in the modern economic science from 2000 to 2022. As of Winter-Spring 2022, this ebook provides fresh insights into the mainstream schools of economic thoughts from the neoclassical synthesis and monetarism to the New Keynesian framework and Keynesian search theory. Furthermore, this ebook focuses on the competitive advantages, opportunities, risks, and threats etc of both tech titans and megabanks in the modern age of digital tech proliferation. Fresh opportunities arise in the broader context of Internet search, consumer technology, e-communication, social media, software, e-commerce, and cloud service provision etc. In contrast, the primary threat is closer antitrust scrutiny on the sheer size, power, and product market dominance of both tech titans and banks as several regulatory institutions mistrust these corporations in global economic history.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2018-05-27 08:33:00 Sunday ET

The Federal Reserve proposes softening the Volcker rule that prevents banks from placing risky bets on securities with deposit finance. As part of the po

2018-05-10 07:37:00 Thursday ET

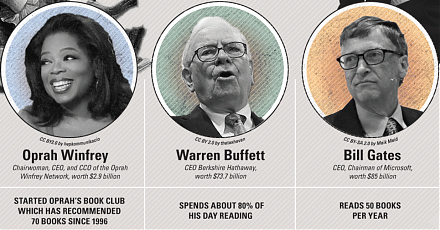

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2020-10-27 07:43:00 Tuesday ET

Most agile lean enterprises often choose to cut costs strategically to make their respective business models fit for growth. Vinay Couto, John Plansky,

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2018-06-14 10:35:00 Thursday ET

The Federal Reserve's current interest rate hike may lead to the next economic recession as credit supply growth ebbs and flows through the business cyc

2018-10-25 10:36:00 Thursday ET

Trump tariffs begin to bite U.S. corporate profits from Ford and Harley-Davidson to Caterpillar and Walmart etc. U.S. corporate profit growth remains high a