Home > Library > Econometric theory and evidence in practice

Author Andy Yeh Alpha

This book provides many useful mathematical exercises in graduate econometric theory and practice. Many quantitative exercises, examples, codes, and solutions draw from the collective wisdom of major econometric books by Greene, Hamilton, Hayashi, White, and Wooldridge etc. The reader can benefit from these solutions with many mathematical equations and notations to become familiar with the core curriculum for econometric theory and practice. The main topics cover (non)linear least squares theory, quasi-maximum likelihood estimation, minimax estimation, financial time-series econometric theory (ARMA-GARCH, ARMA-EGARCH, and ARMA-GJR-GARCH), generalized method of moments (GMM) with exogenous instrumental variables, panel data estimation with endogeneity and unobservable heterogeneity, binary response model estimation (i.e. probit and logit), multinomial response model estimation (conditional logit and Berry-Levinsohn-Pakes random-coefficients mixed logit), Tobit model estimation with corner solutions, Heckman sample selection model estimation, and so forth.

econometric theory jeffrey wooldridge lars hansen john cochrane james hamilton william greene least squares regression maximum likelihood estimation financial time-series arma garch gmm vector autogression endogeneity dynamic panel data estimation probit logit tobit multinomial response model estimation heckman sample selection model

Description:

This book provides many useful mathematical exercises in graduate econometric theory and practice. Many quantitative exercises, examples, codes, and solutions draw from the collective wisdom of major econometric books by Greene, Hamilton, Hayashi, White, and Wooldridge etc. The reader can benefit from these solutions with many mathematical equations and notations to become familiar with the core curriculum for econometric theory and practice. The main topics cover (non)linear least squares theory, quasi-maximum likelihood estimation, minimax estimation, financial time-series econometric theory (ARMA-GARCH, ARMA-EGARCH, and ARMA-GJR-GARCH), generalized method of moments (GMM) with exogenous instrumental variables, panel data estimation with endogeneity and unobservable heterogeneity, binary response model estimation (i.e. probit and logit), multinomial response model estimation (conditional logit and Berry-Levinsohn-Pakes random-coefficients mixed logit), Tobit model estimation with corner solutions, Heckman sample selection model estimation, and so forth.

This analytic ebook cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This ebook shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2019-06-01 10:33:00 Saturday ET

Top tech firms such as Google, Intel, and Qualcomm suspend Android services to HuaWei as the Trump administration blacklists the Chinese company. HuaWei can

2018-05-06 07:30:00 Sunday ET

President Trump withdraws America from the Iran nuclear agreement and revives economic sanctions on Iran for better negotiations as western allies Britain,

2019-01-04 11:41:00 Friday ET

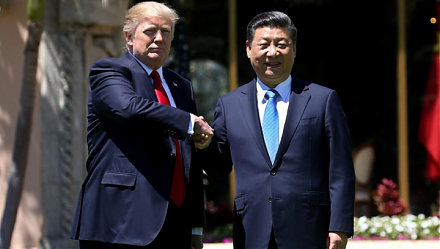

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2018-06-04 08:38:00 Monday ET

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's

2025-06-05 00:00:00 Thursday ET

Former New York Times team journalist and Pulitzer Prize winner Charles Duhigg describes, discusses, and delves into how we can change our respective lives

2019-02-13 11:00:00 Wednesday ET

President Trump may reluctantly sign the congressional border wall deal in order to avert another U.S. government shutdown. With his executive power to decl