2019-07-21 09:37:00 Sunday ET

Facebook introduces a new cryptocurrency Libra as a fresh medium of exchange for e-commerce. Libra will be available to all the 2 billion active users on Fa

2017-05-07 06:39:00 Sunday ET

While the original five-factor asset pricing model arises from a quasi-lifetime of top empirical research by Nobel Laureate Eugene Fama and his long-time co

2023-11-28 11:35:00 Tuesday ET

David Colander and Craig Freedman argue that economics went wrong when there was no neoclassical firewall between economic theories and policy reforms. D

2025-04-30 08:27:00 Wednesday ET

The multiple layers of the world cloud Internet help expand what can be made digitally viable from electric vehicles (EV) and virtual reality (VR) headsets

2020-11-22 11:30:00 Sunday ET

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2023-11-14 08:24:00 Tuesday ET

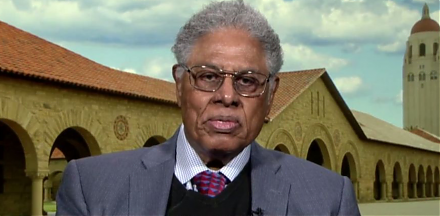

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo