2019-03-23 09:31:00 Saturday ET

Congresswoman Alexandria Ocasio-Cortez proposes greater public debt finance with minimal tax increases for the Green New Deal. In accordance with the modern

2023-05-14 12:31:00 Sunday ET

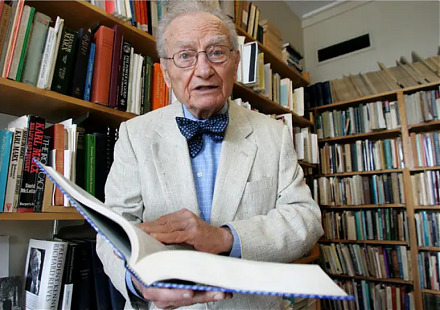

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2018-01-03 08:38:00 Wednesday ET

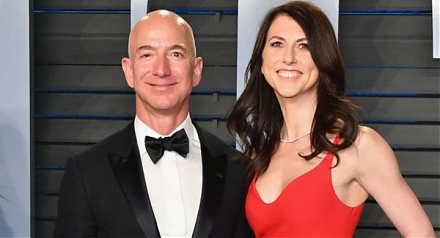

President Trump targets Amazon in his call for U.S. Postal Service to charge high delivery prices on the ecommerce giant. Trump picks another fight with an

2022-03-05 09:27:00 Saturday ET

Addendum on empirical tests of multi-factor models for asset return prediction Fama and French (2015) propose an empirical five-factor asset pricing mode

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out

2018-08-15 14:40:00 Wednesday ET

Senator Elizabeth Warren advocates the alternative view that most U.S. trade deals serve corporate interests over workers, customers, and suppliers etc. She