2016-10-01 00:00:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

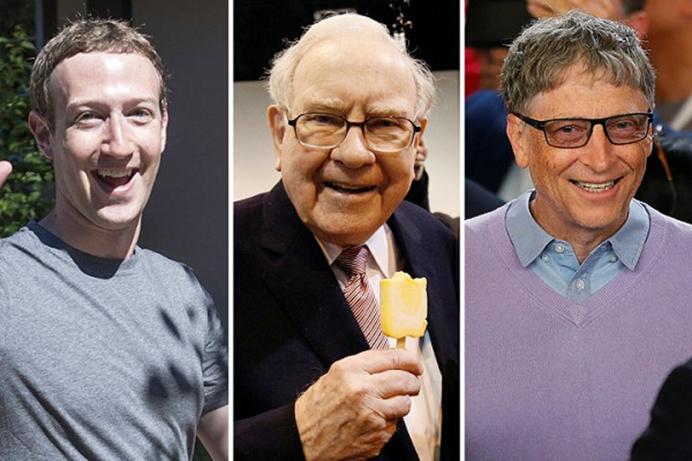

We can learn much from the frugal habits and lifestyles of several billionaires on earth.

Warren Buffett, Chairman and CEO of Berkshire Hathaway, still lives in the same home that he bought for $31,500 in 1958.

Mark Zuckerberg, CEO and Founder of Facebook, now still drives a manual-transmission Volkswagen hatchback almost on a daily basis.

Adorning Bill Gates's wrist is a $10 watch, and Gates likes to wash the dishes at home every night for his family.

Carlos Slim Helú, Founder of Grupo Carso, has lived in the same six-bedroom house for more than 40 years.

Charlie Ergen, Chairman of Dish Network, still packs a brown-bag lunch everyday.

Amancio Ortega, Founder of Inditex, eats lunch with his employees in the Zara headquarters cafeteria.

Ingvar Kamprad, Founder of IKEA, still flies economy-class and often rides the bus.

Azim Premji, Chairman of Wipro, drives second-hand cars and often reminds employees to turn off the lights at the office.

Judy Faulkner, Founder of Epic Systems, confesses that she has never been interested in living a lavish life.

We can learn a great deal from these investors by choosing to lead a productive lifestyle with reasonably frugal habits and choices.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2019-01-27 12:39:00 Sunday ET

British Prime Minister Theresa May faces her landslide defeat in the parliamentary vote 432-to-202 against her Brexit deal. British Parliament rejects the M

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2017-04-19 17:37:00 Wednesday ET

Apple is now the world's biggest dividend payer with its $13 billion dividend payout and surpasses ExxonMobil's dividend payout record. Despite the

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement

2018-06-10 19:41:00 Sunday ET

Apple enters a multi-year content partnership with Oprah Winfrey to provide new original online video and TV programs in direct competition with Netflix, Am