2016-10-01 00:00:00 Sat ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

We can learn much from the frugal habits and lifestyles of several billionaires on earth.

Warren Buffett, Chairman and CEO of Berkshire Hathaway, still lives in the same home that he bought for $31,500 in 1958.

Mark Zuckerberg, CEO and Founder of Facebook, now still drives a manual-transmission Volkswagen hatchback almost on a daily basis.

Adorning Bill Gates's wrist is a $10 watch, and Gates likes to wash the dishes at home every night for his family.

Carlos Slim Helú, Founder of Grupo Carso, has lived in the same six-bedroom house for more than 40 years.

Charlie Ergen, Chairman of Dish Network, still packs a brown-bag lunch everyday.

Amancio Ortega, Founder of Inditex, eats lunch with his employees in the Zara headquarters cafeteria.

Ingvar Kamprad, Founder of IKEA, still flies economy-class and often rides the bus.

Azim Premji, Chairman of Wipro, drives second-hand cars and often reminds employees to turn off the lights at the office.

Judy Faulkner, Founder of Epic Systems, confesses that she has never been interested in living a lavish life.

We can learn a great deal from these investors by choosing to lead a productive lifestyle with reasonably frugal habits and choices.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-01-01 13:39:00 Wednesday ET

President Trump approves a phase one trade agreement with China. This approval averts the introduction of new tariffs on Chinese imports. In return, China s

2017-02-01 14:41:00 Wednesday ET

President Trump refreshes his public image through his presidential address to Congress with numerous ambitious economic policies in order to make America g

2019-07-13 07:17:00 Saturday ET

Japanese prime minister Shinzo Abe outlines the main economic priorities for the G20 summit in Osaka, Japan. First, Asian countries need to forge the key Re

2018-05-13 08:33:00 Sunday ET

Incoming New York Fed President John Williams suggests that it is about time to end forward guidance in order to stop holding the financial market's han

2017-05-13 07:28:00 Saturday ET

America's Top 5 tech firms, Apple, Alphabet, Microsoft, Amazon, and Facebook have become the most valuable publicly listed companies in the world. These

2017-09-19 05:34:00 Tuesday ET

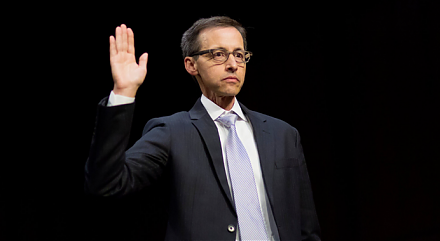

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el