2019-07-19 18:40:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

We can decipher valuable lessons from the annual letters to shareholders written by Amazon CEO Jeff Bezos. Amazon is highly customer-centric because the word variants of *customer and customers* attain the highest word count in each of his annual letters to Amazon shareholders in 1997-2003, 2008-2009, and 2012-2017. In addition to this customer focus, each letter indicates a clear concern with robust financial health. As Bezos reiterates in his letter to Amazon shareholders back in 2004, he emphasizes that the *ultimate long-term financial measure [for Amazon] is free cash flow per share*. This focus sheds new light on Amazon corporate value creation via cash capital utilization that drives steady free cash flow growth in the long run.

Another major aspect of Amazon business focus from 2007 to present relates to planting seeds of firm expansion into key ventures such as Kindle e-reader devices, Amazon Web Services (AWS), and self-service e-commerce platform features and improvements for cost-effective sales and fast delivery services. At Amazon, the most transformative inventions empower authors, auctioneers, third-party sellers, and other network members to unleash their creativity. On balance, Bezos believes in an optimal level of customer centricity, and he cares for other stakeholders such as blue-collar employees, content providers, and third-party sellers etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-10-13 08:27:00 Tuesday ET

Agile lean enterprises strive to design radical business models to remain competitive in the face of nimble startups and megatrends. Carsten Linz, Gunter

2018-03-27 07:33:00 Tuesday ET

CNBC's business anchorwoman Becky Quick interviews Nobel Laureate Joseph Stiglitz on the current trade war between America and China. As America imposes

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20

2019-10-09 16:46:00 Wednesday ET

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form

2019-09-15 14:35:00 Sunday ET

U.S. Treasury officially designates China a key currency manipulator in the broader context of Sino-American trade dispute resolution. The U.S. Treasury cla

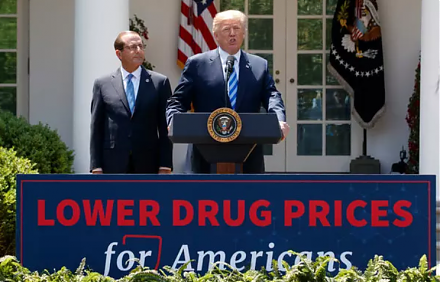

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri