2017-12-17 11:41:00 Sun ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Warren Buffett points out that it is important to invest in oneself. Learning about oneself empowers him or her to lead a meaningful life. This valuable investment should focus on better communication that leads to exponential returns. Buffett mentions Dale Carnegie's timeless bestseller, "How to win friends and influence people", which emphasizes the importance of speaking confidently to express one's own thoughts and ideas in public. This skill enables Buffett to sell stocks more easily when he has to do so later in his financial career.

Another important life lesson from Carnegie suggests that one should never engage in a hot debate with others. A hot debate not only alienates both sides but also reinforces each other's strong views and opinions. It is more important to learn to be cooperative and collegial with others. Close collaboration and teamwork can accomplish much more than personal warfare, retaliation, and conflict entrenchment. We should learn these wise life lessons to be open and positive in a broader team context where every team player wins. Trust trumps disagreement in most positive interpersonal interactions.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-05-14 12:31:00 Sunday ET

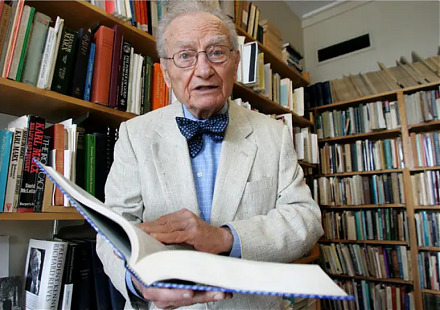

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2019-02-03 13:39:00 Sunday ET

It can be practical for the U.S. to impose the 2% wealth tax on the rich. Democratic Senator Elizabeth Warren proposes a 2% wealth tax on the richest Americ

2017-11-03 06:41:00 Friday ET

Broadcom, a one-time division of Hewlett-Packard and now a semiconductor maker whose chips help power iPhone X, has announced its strategic plans to move it

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2018-08-23 11:34:00 Thursday ET

Harvard financial economist Alberto Cavallo empirically shows the recent *Amazon effect* that online retailers such as Amazon, Alibaba, and eBay etc use fas