2017-07-19 11:35:00 Wed ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

This brief article encapsulates the timeless wisdom of Warren Buffett's famous quotes on fundamental stock investment, fear and greed, patience, risk control, success, prediction, gold, and so on.

Buffett often spins and taints his words of wisdom with a healthy sense of humor.

As a contrarian value investor, Buffett buys shares when the stock price falls below its intrinsic value, and then (seldom) sells these shares when the stock price rises above its intrinsic value by a wide margin.

Recent empirical studies affirm this stock investment philosophy that a wise long-term investor should bet his or her money on small and profitable individual companies with low asset growth and high book-to-market equity.

Betting against high market beta or short-term price momentum is no longer the conventional wisdom within the broader conceptual framework of fundamental stock investment.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-02-03 07:42:00 Saturday ET

Quant Quake 2.0 shakes investor confidence with rampant stock market fears and doubts during the recent Fed Chair transition from Janet Yellen to Jerome Pow

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2019-05-02 13:30:00 Thursday ET

Netflix has an unsustainable business model in the meantime. Netflix maintains a small premium membership fee of $9-$14 per month for its unique collection

2020-11-22 11:30:00 Sunday ET

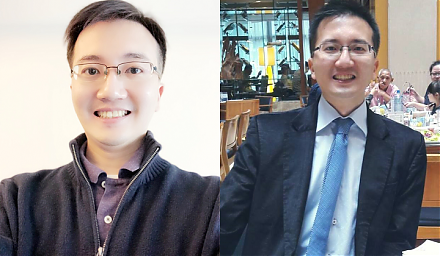

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network pla

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg

2020-09-15 08:38:00 Tuesday ET

Macro eigenvalue volatility helps predict some recent episodes of high economic policy uncertainty, recession risk, or rare events such as the recent rampan