2018-11-15 12:35:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Warren Buffett approves Berkshire Hathaway to implement new meaningful stock repurchases. Buffett sends a positive signal to the stock market with the Berkshire $1 billion stock buyback. This stock buyback program involves $1 billion Berkshire Hathaway share repurchases as of 2018Q3 and thus boosts the share price almost 5% in early-November 2018. This program can continue into the final weeks of the current calendar year.

From July 2018 to November 2018, Berkshire has been an active net buyer of $24 billion U.S. stocks. This decision doubles the overall dollar volume in the first half of the current year. Until July 2018, Berkshire Hathaway would repurchase shares only if the stock price fell below 120% of its book value (about $152 per share as of October 2018). A recent amendment allows Warren Buffett and Charlie Munger to approve share repurchases if they believe that the stock price is lower than its intrinsic value. This amendment provides greater flexibility for new stock buyback programs and so results in meaningful share repurchases at Berkshire Hathaway. Warren Buffett points out that the intrinsic value of Berkshire Hathaway far exceeds its book value particularly in the property and casualty insurance businesses.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-10-11 14:33:00 Saturday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi

2019-01-13 12:37:00 Sunday ET

We need crowdfunds to support our next responsive web design and iOS and Android app development. Upon successful campaign completion, we will provide an eb

2020-08-12 07:25:00 Wednesday ET

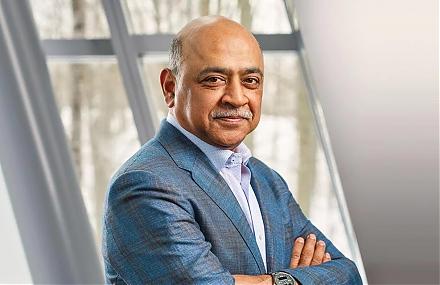

Most sustainably successful business leaders make a mark in the world, create a positive impact, and challenge the status quo. Jerry Porras, Stewart Emer

2019-05-05 10:34:00 Sunday ET

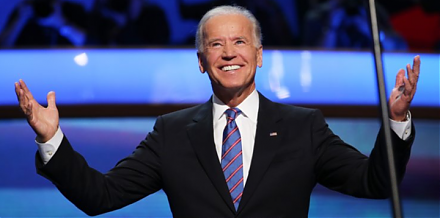

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou

2018-02-11 07:30:00 Sunday ET

President Trump unveils his ambitious $1.5 trillion public infrastructure plan. Trump proposes offering $100 billion in federal incentives to encourage stat