2018-11-15 12:35:00 Thu ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Warren Buffett approves Berkshire Hathaway to implement new meaningful stock repurchases. Buffett sends a positive signal to the stock market with the Berkshire $1 billion stock buyback. This stock buyback program involves $1 billion Berkshire Hathaway share repurchases as of 2018Q3 and thus boosts the share price almost 5% in early-November 2018. This program can continue into the final weeks of the current calendar year.

From July 2018 to November 2018, Berkshire has been an active net buyer of $24 billion U.S. stocks. This decision doubles the overall dollar volume in the first half of the current year. Until July 2018, Berkshire Hathaway would repurchase shares only if the stock price fell below 120% of its book value (about $152 per share as of October 2018). A recent amendment allows Warren Buffett and Charlie Munger to approve share repurchases if they believe that the stock price is lower than its intrinsic value. This amendment provides greater flexibility for new stock buyback programs and so results in meaningful share repurchases at Berkshire Hathaway. Warren Buffett points out that the intrinsic value of Berkshire Hathaway far exceeds its book value particularly in the property and casualty insurance businesses.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2017-07-19 11:35:00 Wednesday ET

This brief article encapsulates the timeless wisdom of Warren Buffett's famous quotes on fundamental stock investment, fear and greed, patience, risk co

2022-05-15 10:29:00 Sunday ET

Innovative investment theory and practice Corporate investment can be in the form of real tangible investment or intangible investment. The former conce

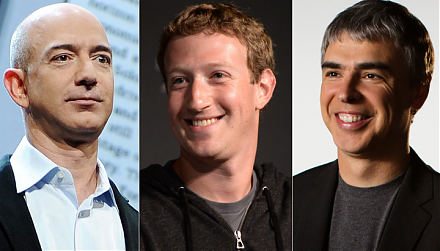

2018-11-19 09:38:00 Monday ET

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2017-08-25 13:36:00 Friday ET

The U.S. Treasury's June 2017 grand proposal for financial deregulation aims to remove several aspects of the Dodd-Frank Act 2010 such as annual macro s

2019-05-21 12:37:00 Tuesday ET

Chicago finance professor Raghuram Rajan shows that free markets need populist support against an unholy alliance of private-sector and state elites. When a