2019-01-19 12:38:00 Sat ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

U.S. government shuts down again because House Democrats refuse to spend $5 billion on the border wall that would give President Trump great victory on his best-known policy. No other OECD democracy has such abrupt government shutdowns. Should the current U.S. government shutdown be about policy differences, House Democrats would try to achieve a compromise deal with the Trump administration.

Nevertheless, this congressional standoff is about presidential authority. President Trump must win this fight; otherwise, he would allow House Democrats to constrain his presidential power. A key concern is that President Trump may use his national emergency power to build the southern border wall. In this worse-case scenario, the eventual degradation of good government may continue.

In reality, the current U.S. government shutdown happens not because America is in turmoil: the country is not at war; the economy operates near full employment; and even Fed Chair Jerome Powell praises the robust economic outlook with low inflation and high productivity growth. The current government shutdown happens because President Trump needs to fulfill one of the most controversial campaign promises that his fervent followers favor. When the U.S. government reopens, both Congress and the Trump administration can revisit the comprehensive issues of border security and immigration reform without having to inflict financial pain on public employees in the specific form of furlough or work without pay.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-04-07 15:34:00 Friday ET

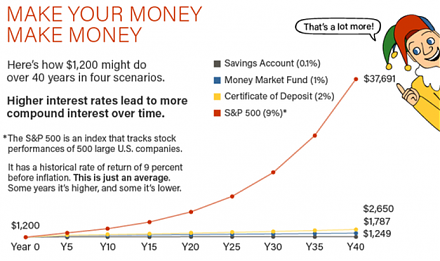

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive

2019-08-05 13:30:00 Monday ET

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 bil

2018-09-29 12:39:00 Saturday ET

The Securities and Exchange Commission (S.E.C.) sues Elon Musk for his August 2018 tweet that he has secured external finance to convert Tesla into a privat

2018-10-19 13:37:00 Friday ET

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations o

2017-08-01 09:40:00 Tuesday ET

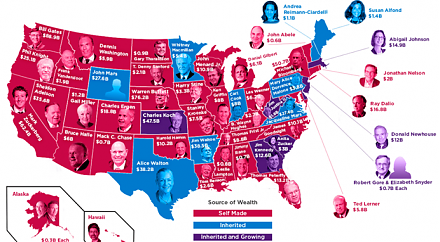

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2024-10-14 11:33:00 Monday ET

Stock Synopsis: Video games continue to take both screen time and monetization from many other forms of entertainment. We are broadly positive about the