2019-01-19 12:38:00 Sat ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

U.S. government shuts down again because House Democrats refuse to spend $5 billion on the border wall that would give President Trump great victory on his best-known policy. No other OECD democracy has such abrupt government shutdowns. Should the current U.S. government shutdown be about policy differences, House Democrats would try to achieve a compromise deal with the Trump administration.

Nevertheless, this congressional standoff is about presidential authority. President Trump must win this fight; otherwise, he would allow House Democrats to constrain his presidential power. A key concern is that President Trump may use his national emergency power to build the southern border wall. In this worse-case scenario, the eventual degradation of good government may continue.

In reality, the current U.S. government shutdown happens not because America is in turmoil: the country is not at war; the economy operates near full employment; and even Fed Chair Jerome Powell praises the robust economic outlook with low inflation and high productivity growth. The current government shutdown happens because President Trump needs to fulfill one of the most controversial campaign promises that his fervent followers favor. When the U.S. government reopens, both Congress and the Trump administration can revisit the comprehensive issues of border security and immigration reform without having to inflict financial pain on public employees in the specific form of furlough or work without pay.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-21 12:37:00 Tuesday ET

Chicago finance professor Raghuram Rajan shows that free markets need populist support against an unholy alliance of private-sector and state elites. When a

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has

2023-05-14 12:31:00 Sunday ET

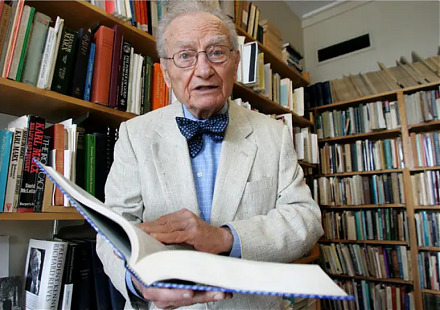

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2019-04-09 11:29:00 Tuesday ET

The U.S. Treasury yield curve inverts for the first time since the Global Financial Crisis. The key term spread between the 10-year and 3-month U.S. Treasur

2018-07-11 09:39:00 Wednesday ET

In recent times, the Trump administration sees the sweet state of U.S. economic expansion as of early-July 2018. The latest CNBC All-America Economic Survey

2023-12-03 11:33:00 Sunday ET

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati