2022-11-25 09:29:00 Fri ET

stock market alpha value momentum behavioral finance size eugene fama ken french capm fama-french factor model mean-variance efficiency mutual fund management sharpe ratio william sharpe harry markowitz john cochrane profitability asset growth capital investment market risk default risk

While the agency and precautionary-motive stories are complementary, these stories can be nested as special cases within the uniform field theory of corporate finance by Lambrecht and Myers (JF 2012, 2015). In normal times, shareholders demand regular and smooth dividend payout while corporate incumbents exhibit habit persistence in their managerial rent protection (Fama and French, JFE 2001; DeAngelo, DeAngelo, and Skinner, JFE 2004; Skinner, JFE 2008; Leary and Michaley, RFS 2011; Michaely and Roberts, RFS 2011). This dividend payout depletes the internal cash reservoirs or free cash flows, and in turn induces corporate incumbents to disgorge regular cash for better agency control (Jensen, AER 1986; Stulz, JFE 1990; Dittmar, Mahrt-Smith, and Servaes, JFQA 2003; Dittmar and Mahrt-Smith, JFE 2007; Skinner, JFE 2008; Harford, Mansi, and Maxwell, JFE 2008). The typical investor's response can be different at unique junctures of financial stress throughout the business cycle. When the firm hoards excess cash for precautionary concerns (Opler, Pinkowitz, Stulz, and Williamson, JF 1999; Almeida, Campello, and Weisbach, JF 2004; Faulkender and Wang, JF 2006; Bates, Kahle, and Stulz, JF 2009; Harford, Klasa, and Maxwell, JF 2014), the resultant cash balance serves as a countercyclical capital buffer against adverse external shocks to corporate earnings growth.

Changes in the firm's financial flexibility in the form of both available debt capacity and net share issuance have a first-order impact on the firm's capital structure choice (DeAngelo, DeAngelo, and Whited, JFE 2011; McLean, JFE 2011; Denis and McKeon, RFS 2012). To the extent that corporate incumbents spend cash quickly on lumpy and volatile M&A, R&D, and capital overinvestments (Titman, Wei, and Xie, JFQA 2004; Malmendier and Tate, JF 2005, JFE 2008; Hirshleifer, Low, and Teoh, JFE 2012; Harford et al, JFE 2012), cash and share buyback fluctuations absorb the variation in residual income (Harford, Mansi, and Maxwell, JFE 2008; Skinner, JFE 2008). This residual income can be distributed as regular and smooth dividend payout or one-off discretionary share buyback (Harford, Mansi, and Maxwell, JFE 2008; Skinner, JFE 2008; Leary and Michaely, RFS 2011; Michaely and Roberts, RFS 2011; Peyer and Vermaelen, RFS 2009; Dittmar and Field, JFE 2015). This uniform field theory of corporate finance interconnects managerial rent protection to corporate investment, cash retention, capital structure, and payout management.

Neoclassic studies show some form of home bias in international stock portfolio under-diversification (Huberman and Kandel, JF 1987; Hansen and Richard, ECMT 1987; Hansen and Jagannathan, JPE 1991; Harvey, 1991; Glen and Jorion, JF 1993). Errunza, Hogan, and Hung (JF 1999) empirically find that home-made portfolios of U.S. domestically traded stocks, ADRs, and MNCs can mimic international stock market indices. Both mean-variance spanning tests and Sharpe ratio tests suggest that portfolio efficiency gains beyond home-made diversification are economically insignificant. This evidence suggests that it is not necessary for U.S. asset managers to trade abroad to reap significantly better international stock portfolio diversification benefits.

Eun, Huang, and Lai (JFQA 2008) report evidence in support of the alternative view that regional small-cap stocks exhibit low return correlations with all the other international large-cap, mid-cap, and small-cap stocks. These low return correlations suggest that it is difficult to find common exposures to global factors in the mean-variance spanning tests for small-cap stocks. The extra portfolio efficiency gains from international stock portfolio diversification with regional small-cap funds are econometrically significant. Specifically, the inclusion of small-cap stocks can increase the Sharpe ratio from 0.24 to 0.64+ while this increase is econometrically significant. A geometric interpretation of this evidence is that global diversification with regional small stocks shifts the efficient frontier in the northwest direction.

Fama and French (JFE 2012) further find that regional size, value, and momentum stock portfolios do not exhibit common exposures to global Fama-French factors. Alternatively, regional Fama-French factors outperform their global counterparts in explaining the variation in anomalous stock returns on size, value, and momentum tilts. This evidence suggests at best partial global stock market integration, and therefore there is still ample room for international stock portfolio diversification. Future research can delve into the new mean-variance spanning tests and Sharpe ratio tests for different stock anomaly tilts (e.g. size, value, and momentum) and asset classes such as bonds, ETFs, and derivatives.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-09-15 08:38:00 Tuesday ET

Macro eigenvalue volatility helps predict some recent episodes of high economic policy uncertainty, recession risk, or rare events such as the recent rampan

2019-04-19 12:35:00 Friday ET

Federal Reserve proposes to revamp post-crisis rules for U.S. banks. The current proposals would prescribe materially less strict requirements for community

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2021-05-20 10:30:00 Thursday ET

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology. Core trade technological advances and disruptive

2018-11-09 11:35:00 Friday ET

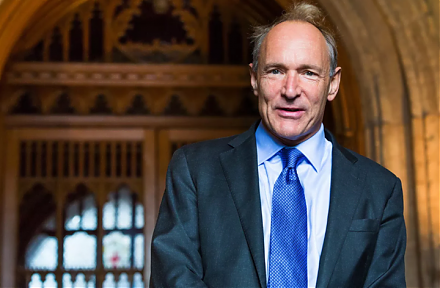

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2018-10-09 08:40:00 Tuesday ET

The International Monetary Fund (IMF) appoints Harvard professor Gita Gopinath as its chief economist. Gopinath follows her PhD advisor and trailblazer Kenn