2019-10-15 09:13:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no-deal Brexit in late-October 2019. In addition to losing this vote, Johnson also loses the Conservative one-person majority as Conservative MP Phillip Lee crosses the floor to join the Liberal Democrats. In light of this parliamentary change, Johnson seeks a general election in mid-October 2019 and further threatens to eject all of the 21 Conservative MPs who oppose a hard Brexit.

In response, the opposition parties support setting in stone anti-no-deal Brexit law. The British parliament blocks Brexit with no deal with the European Union, and the House of Lords must give assent to legislate this outcome. Moreover, the British parliament prevents Johnson from instituting a snap general election.

Johnson experiences 3 parliamentary rebukes in 2 consecutive days at the early stage of his new premiership. In reality, there are good economic reasons for anti-Brexit investor anxiety and even a second referendum. Stock market analysts and currency strategists fear that Brexit would lead to substantial trade retrenchment, substantial British pound volatility, and financial capital exodus. After all, European Union remains the biggest trade bloc for Britain.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-06-03 11:31:00 Monday ET

The Sino-U.S. trade war may be the Thucydides trap or a clash of Caucasian and non-Caucasian civilizations. The proverbial Thucydides trap refers to the his

2018-06-06 09:39:00 Wednesday ET

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bila

2017-04-25 06:35:00 Tuesday ET

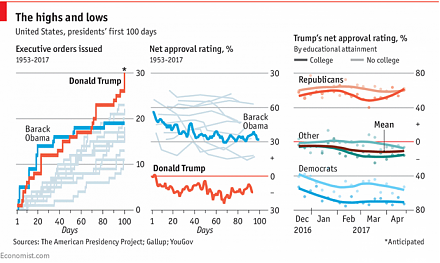

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2019-03-07 12:39:00 Thursday ET

A physicist derives a mathematical formula that success equates the product of both personal quality and the potential value of a random idea. As a Northeas

2017-01-11 11:38:00 Wednesday ET

Thomas Piketty's recent new book *Capital in the Twenty-First Century* frames income and wealth inequality now as a global economic phenomenon. When

2018-07-09 09:39:00 Monday ET

The Federal Reserve raises the interest rate again in mid-2018 in response to 2% inflation and wage growth. The current neutral interest rate hike neither b