2019-10-15 09:13:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no-deal Brexit in late-October 2019. In addition to losing this vote, Johnson also loses the Conservative one-person majority as Conservative MP Phillip Lee crosses the floor to join the Liberal Democrats. In light of this parliamentary change, Johnson seeks a general election in mid-October 2019 and further threatens to eject all of the 21 Conservative MPs who oppose a hard Brexit.

In response, the opposition parties support setting in stone anti-no-deal Brexit law. The British parliament blocks Brexit with no deal with the European Union, and the House of Lords must give assent to legislate this outcome. Moreover, the British parliament prevents Johnson from instituting a snap general election.

Johnson experiences 3 parliamentary rebukes in 2 consecutive days at the early stage of his new premiership. In reality, there are good economic reasons for anti-Brexit investor anxiety and even a second referendum. Stock market analysts and currency strategists fear that Brexit would lead to substantial trade retrenchment, substantial British pound volatility, and financial capital exodus. After all, European Union remains the biggest trade bloc for Britain.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-10-13 12:32:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2025-06-13 08:23:00 Friday ET

What are the mainstream legal origins of President Trump’s new tariff policies? We delve into the mainstream legal origins of President Trump&rsquo

2019-01-08 17:46:00 Tuesday ET

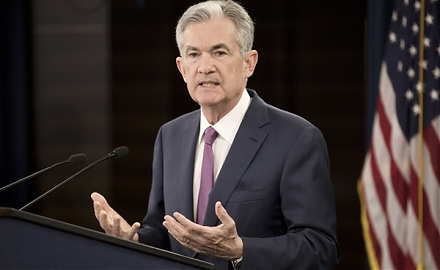

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2023-11-14 08:24:00 Tuesday ET

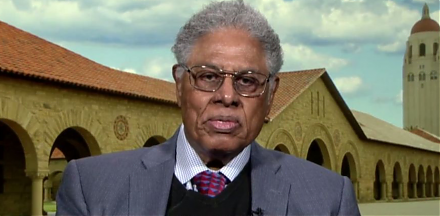

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2019-01-23 11:32:00 Wednesday ET

Higher public debt levels, global interest rate hikes, and subpar Chinese economic growth rates are the major risks to the world economy from 2019 to 2020.

2019-06-05 10:34:00 Wednesday ET

Fed Chair Jay Powell suggests that the recent surge in U.S. business debt poses moderate risks to the economy. Many corporate treasuries now carry about 40%