2018-07-03 11:42:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump's current trade policies appear like the Reagan administration's protectionist trade policies back in the 1980s. In comparison to the previous target of Japan back in the 1980s, the current target is China that causes large perennial U.S. trade deficits nowadays.

In the 1980s, President Reagan and Republican senators worried about the sharp increases in U.S. trade deficits with Japan and its aggressive entry into particular industries where America used to dominate in history. The Reagan administration focused on automobiles, steel exports, and semiconductors. The 1980s trade war involved a specific taxonomy of tariffs, quotas, and even embargoes on Japanese companies in these fields. Eventually, the 1980s trade policies led to the Reagan administration’s inability to tame trade deficit growth. In fact, the U.S. trade deficit exacerbated from $36 billion or 1.3% of total GDP in 1980 to $170 billion or 3.7% of total GDP in 1989. Not only did the Reagan tariffs and quotas fail to deliver high economic growth in the aftermath of the 1987 stock market crash, these measures constrained economic output expansion from trickling down to benefit the typical American.

Several economic lessons emerge from this historical context. First, erecting trade barriers may not necessarily shrink the current U.S. trade deficit. These tariffs and quotas may or may not reverse the current Sino-American trade dilemma. Second, U.S. consumers, households, and companies may end up paying higher prices for intermediate goods and services in the specific areas of steel, aluminum, and other tech-savvy intellectual properties. Higher inflation induces the Federal Reserve to accelerate the current interest rate hike that in turn adversely affects U.S. financial market developments. Third, the specific industries such as steel, aluminum, and semiconductor technology may receive little help in light of higher production costs. When China and the European Union lash back with retaliatory tariffs and quotas, some U.S. companies such as Harley Davidson would have no choice but to move production overseas. The resultant decrease in total demand for domestic blue-collar workers may mean an inevitable increase in unemployment in these heavy-metal industries.

This adverse impact may spill over toward American agriculture that relies heavily on its exports to Canada, China, Europe, and Mexico. As history may repeat itself, the law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S

2018-01-05 07:37:00 Friday ET

Warren Buffett cleverly points out that American children will not only be better off than their parents, but the former will also enjoy higher living stand

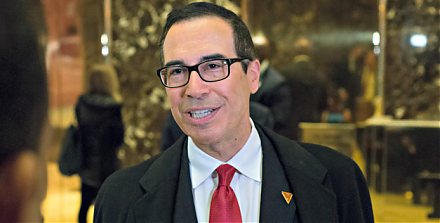

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2019-07-07 18:36:00 Sunday ET

The Chinese central bank has to circumvent offshore imports-driven inflation due to Renminbi currency misalignment. Even though China keeps substantial fore

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones

2018-09-01 07:34:00 Saturday ET

As the French economist who studies global economic inequality in his recent book *Capital in the New Century*, Thomas Piketty co-authors with John Bates Cl