2017-03-21 09:37:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Trump and Xi meet in the most important summit on earth this year.

Trump has promised to retaliate against China's currency misalignment, steel trade practice, manipulative ownership of U.S. government bonds, and passive attitude toward the deterrence of North Korean nuclear threats, whereas, Xi serves as a pacifist to Trump's allegation of currency manipulation as the main reason for American $500 billion trade deficit.

The Trump stock market rally reveals that much economic policy uncertainty revolves around whether the Republican administration would impose a new punitive 45% tariff on Chinese imports to counteract the current trade imbalance between the world's most powerful economies.

Many political considerations such as the One-China policy and the anti-nuclear deterrence of North Korea come into play and affect the U.S.-China economic status quo.

Can the Trump administration's economic sanctions manifest in the form of punitive tariff and trade protectionism as quid pro quo for political concessions on the One-China policy and East Asian nuclear non-proliferation?

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-09 13:42:00 Sunday ET

Warren Buffett shares his key insights into life, success, money, and interpersonal communication. Institutional money managers and retail investors ca

2019-07-25 16:42:00 Thursday ET

Platforms benefit from positive network effects, scale economies, and information cascades. There are at least 2 major types of highly valuable platforms: i

2019-01-21 10:37:00 Monday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube January 2019 In this podcast, we discuss several topical issues

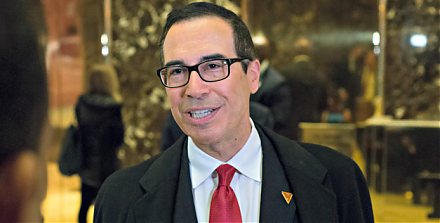

2017-05-25 08:35:00 Thursday ET

Treasury Secretary Steve Mnuchin has released a 147-page report on financial deregulation under the Trump administration. This financial deregulation seeks

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical