2017-11-17 09:42:00 Fri ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

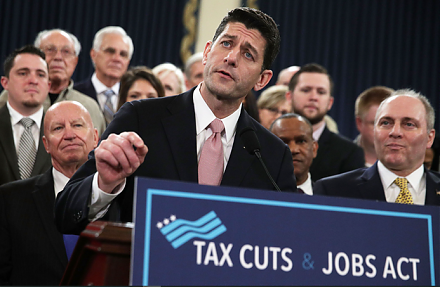

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts & Jobs Act of 2017). With Republican majority in both congressional chambers, this current fiscal reform represents President Trump's first landmark economic policy legislation. The typical supply-side macroeconomist welcomes this fiscal overhaul and expects tax relief to trickle down to most U.S. households as well as corporations. Each American household will expect to benefit from this fiscal legislation in the form of tax cuts from $4,000 to $9,000 per annum. Also, most U.S. corporations face a substantial decrease in the effective corporate income tax rate from 35% to 21%. Furthermore, large U.S. multinational corporations can enjoy tangible tax credits for offshore cash repatriation during the indefinite Trump tax holiday. The Trump administration suggests that this tax overhaul is likely to help boost wage growth, job creation, and labor and capital productivity.

However, some market observers fear that the resultant tax cuts offer key U.S. corporations such as Cisco, Pfizer, and Coca-Cola etc to distribute cash to their shareholders in the form of near-term dividend payout and share buyback.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2018-06-17 10:35:00 Sunday ET

In the past decades, capital market liberalization and globalization have combined to connect global financial markets to allow an ocean of money to flow th

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2017-11-17 09:42:00 Friday ET

The Trump administration garners congressional support from both Senate and the House of Representatives to pass the $1.5 trillion tax overhaul (Tax Cuts &a

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2023-06-28 09:29:00 Wednesday ET

Carmen Reinhart and Kenneth Rogoff delve into several centuries of cross-country crisis data to find the key root causes of financial crises for asset marke