2017-02-19 07:41:00 Sun ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

In his recent book on personal finance, Tony Robbins recommends that each investor should rebalance his or her investment portfolio *only once a year* to invest for the long-term.

Robbins defies the conventional wisdom and so suggests that a smart investor should admit that he or she lacks any special advantage in a myopic attempt to beat the market.

A multi-year investment period extends the time horizon for the typical investor to earn both dividend yields and capital gains with much more probable success.

Robbins also points out that it is pivotal for the typical investor to start investing in stocks for their higher long-run average returns during his or her professional career.

Given the power of exponential compound interest growth, dividend yields and capital gains help accumulate capital wealth much faster.

The typical investor's ability to accumulate passive income determines a larger fraction of his or her wealth at retirement age because this income accumulation follows the law of exponential compound interest growth.

In contrast, the typical investor's salaries and bonuses only represent a smaller fraction of his or her wealth at retirement age because this income accumulates over time with no compound interest.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-07-28 11:28:00 Friday ET

Lucian Bebchuk and Jesse Fried critique that executive pay often cannot help explain the stock return and operational performance of most U.S. public corpor

2020-03-12 09:32:00 Thursday ET

Google CEO Eric Schmidt and his co-authors show the innovative corporate culture and mission of the Internet search tech titan. Eric Schmidt, Jonathan Ro

2019-06-13 10:26:00 Thursday ET

The Chinese Xi administration may choose to leverage its state dominance of rare-earth elements to better balance the current Sino-U.S. trade war. In recent

2019-09-19 15:30:00 Thursday ET

U.S. yield curve inversion can be a sign but not a root cause of the next economic recession. Treasury yield curve inversion helps predict each of the U.S.

2023-11-14 08:24:00 Tuesday ET

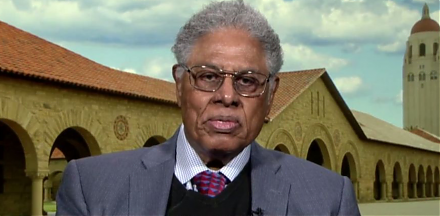

Thomas Sowell argues that some economic reforms inadvertently exacerbate economic disparities. Thomas Sowell (2019) Discrimination and econo

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc