2018-11-09 11:35:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concerns. Tech titans from Facebook to Google have become so dominant that they may need to be broken up unless user taste changes and legal challenges reduce their clout.

Berners-Lee, the British computer scientist who invented the world wide web with no patent protection back in 1989, expresses disappointment with the current state of the Internet in response to the Cambridge Analytica scandals over personal data abuse and breach and political hatred propagation on social media platforms such as Facebook and Google. Berners-Lee suggests that there is an apparent danger of both market dominance and cultural power concentration in a small number of tech giants. Few alternative rivals balance this oligopolistic competition for better user privacy and consumer protection.

As of December 2017, Facebook, Apple, Microsoft, Google, and Amazon (FAMGA) maintain astronomical stock market capitalization of $3.7 trillion, which is equal to the total GDP of Germany in the same fiscal year. Berners-Lee points out that it is important for these tech titans to break up by shifting exorbitant market power from the current oligopoly to some other medium enterprises.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-15 07:41:00 Thursday ET

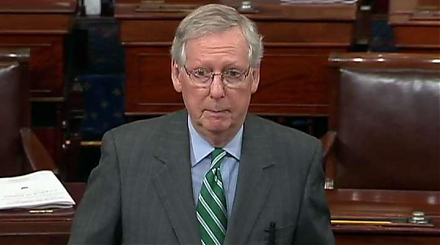

The Trump administration's $1.5 trillion hefty tax cuts and $1 trillion infrastructure expenditures may speed up the Federal Reserve interest rate hike

2018-08-31 08:42:00 Friday ET

We share several famous inspirational stock market quotes by Warren Buffett, Peter Lynch, Benjamin Graham, Ben Franklin, Philip Fisher, and Michael Jensen.

2025-06-28 10:39:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why great mental focus serves as a vital mainstream driver of personal

2019-01-08 17:46:00 Tuesday ET

President Trump forces the Federal Reserve to normalize the current interest rate hike to signal its own monetary policy independence from the White House.

2018-12-22 14:38:00 Saturday ET

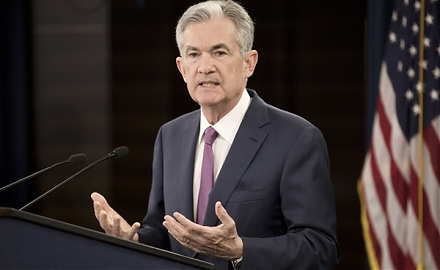

Federal Reserve raises the interest rate to the target range of 2.25% to 2.5% as of December 2018. Fed Chair Jerome Powell highlights the dovish interest ra

2025-06-05 00:00:00 Thursday ET

Former New York Times team journalist and Pulitzer Prize winner Charles Duhigg describes, discusses, and delves into how we can change our respective lives