2018-09-01 07:34:00 Sat ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

As the French economist who studies global economic inequality in his recent book *Capital in the New Century*, Thomas Piketty co-authors with John Bates Clark medal winner and Berkeley professor Emmanuel Saez the latest September 2018 World Inequality Report. This fresh report empirically demonstrates that the rise of income-and-wealth for the top 1% U.S. population mirrors the fall of income-and-wealth for the bottom 50% U.S. population. Specifically, the top 1% cohort rakes in more than 20% of U.S. national income in 2017 in comparison to only 11% back in 1980. At the same time, the bottom 50% cohort receives 12% of U.S. national income in 2017 in comparison to about 20% back in 1980.

Not only do the rich become richer and the poor become poorer, the income and wealth transfers seem simultaneous, synchronous, and causal in time-series data. This stark feature shows an empirically robust increase in U.S. economic inequality over the recent decades.

However, this socioeconomic issue cannot reflect talent concentration in specific labor markets. At least some of this dichotomous wealth inequality arises from the fact that several industries such as biotech, telecom, and social media mold large players with competitive moats into quasi-monopolies. These mega players invest heavily in patents, trademarks, copyrights, and other intellectual properties in order to safeguard their market dominance against external competitive forces.

Nobel Laureate and former chief economist at World Bank Joseph Stiglitz points out that tech titans have become quasi-monopolies with high market concentration. This concentration serves as a primary explanation for worse income and wealth inequality in America. When the network platform orchestrators such as Facebook, Apple, Microsoft, Google, Amazon, Netflix, and Twitter (FAMGANT) reinforce their market strength and dominance, they may violate antitrust laws and regulations. Also, several other industries such as pharmaceutical firms (Johnson & Johnson, Merck, and Pfizer etc) and telecoms (AT&T, Verizon, Sprint, and T-Mobile) are new additions to the checklist of U.S. quasi-monopolies.

This new technological trend aggravates socioeconomic inequality, deepens anti-competitive concerns, and harms consumer benefits in terms of longer-term price and quality improvements.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2018-05-07 07:32:00 Monday ET

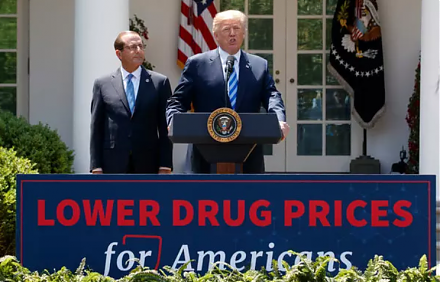

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2018-12-05 09:38:00 Wednesday ET

Federal Reserve publishes its inaugural flagship financial stability report. Fed Chair Jerome Powell applauds both low inflation (2%) and low unemployment (

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati