2023-05-28 10:24:00 Sun ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt technology covid-19 employment inflation global macro outlook interest rate fiscal stimulus economic growth central bank fomc capital global financial cycle gdp output

Thomas Piketty (2017)

Capital in the twenty-first century

In his recent thesis on the modern capitalist economy, Thomas Piketty empirically finds a positive relation between economic growth and inequality worldwide. This conceptual nexus reveals the fundamental forces of economic divergence as both income and wealth inequality tends to dominate in global capitalism. This fairly new economic divergence turns out to be a rare exception to the heuristic rule of thumb. In this fresh light, Piketty proposes fiscal policies that would make global capitalism sustainable in terms of global taxation on top wealth and capital income.

Piketty focuses on the empirical analysis of global income and wealth inequality in the public economic science. Piketty emphasizes the main themes of his empirical work on top income and wealth concentration and distribution worldwide over the past 250 years. In most rich OECD countries, the rate of capital return tends to be persistently greater than the rate of economic growth. This empirical phenomenon can cause wealth and income inequality to increase in the future. To address this perennial problem, Piketty proposes redistributive social transfers via progressive global taxation on top wealth and capital income.

Piketty views wealth and income inequality as a social phenomenon that arises as a result of human institutions. Institutional reforms often reflect the long prevalent ideology in the modern society. In his view, wealth and income inequality is neither economic nor technological. This inequality is often ideological in the political arena. Piketty advocates several feasible methods for wealth and income redistribution in terms of basic income inheritance for all. This basic income inheritance distributes income for all adults beyond the age of 25 years old. This rather radical economic proposal complements the current system of social welfare transfers in many ways. Economic inequality has become a pervasive phenomenon in most Euro-American, post-Soviet, Chinese, Indian, and other modern societies in the new century.

Piketty revives the original study of income inequality by Vilfredo Pareto and Simon Kuznets. This study comprises the pragmatic rigorous use of fiscal tax data, rather than household survey data, and hence this study is particularly powerful in delving into the distribution of top income and wealth cohorts. This focus on the top income and wealth cohorts makes Piketty, many public economists, and the general public more aware of the rich and their absolute income and wealth levels (in contrast to broader distributional studies of Gini coefficients for economic inequality). In close collaboration with his co-authors (such as Berkeley macro economists Emmanuel Saez and Gabriel Zucman), Piketty builds and maintains the impressive interactive database on world top wealth and income for 27 countries worldwide.

In America, median income has been relatively stagnant in real terms for 40 years, whereas, the top 1% income cohorts have dramatically boosted their share of total U.S. income to more than 20%. The recent rise in the political importance of wealth and income inequality reaches its pinnacle at the time of political activism in close association with the Occupy Wall Street movement worldwide. Piketty, Saez, and Zucman focus on the 99% versus 1% slogan in the political rhetoric of sharp wealth and income inequality in America. Persistent wealth and income concentration can be a real impediment to upward economic mobility in the modern capitalist society. Piketty presents 2 to 3 centuries of empirical data on capital and economic output, national income concentration, return on capital, inheritance, core inflation, and so forth for most rich economies such as America, Britain, Canada, France, Germany, Japan, and Sweden. Piketty examines the main policy implications of his empirical analysis of capitalism. Economic inequality emerges as an important facet of this broader analysis. Piketty delves into fiscal tax data on the capital-income ratio, the functional distribution of national income, and their long-run trends for public policy prescriptions. In a nutshell, Piketty, Saez, Zucman, and their long-time co-authors support the empirical foundations for global taxation on top wealth, capital income, and family fortune inheritance.

In the Ricardian fashion, Piketty builds a simple model to capture the main features of a modern capitalist economy. Piketty then applies this model to illustrate the key comparison of both the past and the future. This model comprises one definitional relation, 2 fundamental economic laws of capitalism, and an inequality relation. By definition, the stock of capital includes all forms of assets with regular returns and cash flows: residential real estate, land, machinery, financial capital (in the form of cash), share and bond issuance, intellectual property, and even human capital. In this general sense, capital is similar to what often constitutes wealth. Piketty shows that beta refers to the ratio between capital and income per annum. From historical economic studies of America, Britain, and France, Piketty suggests that beta has followed a U-shape pattern since the French Revolution. Through this long period, the capital-to-income ratio has declined from about 7 to 3.5 before and after World Wars I and II, and then has risen again back to about 8 in the past 30 years. Piketty provides ample evidence to suggest that this process characterizes almost all rich OECD countries. The full significance of recent increases in beta relates to the first fundamental economic law of capitalism. In accordance with this law, Piketty states that the capital-to-output ratio (or alpha) is equal to the real rate of return on capital times beta. Piketty uses the letter r to denote the real rate of return on capital, and Piketty uses the letter g to denote the rate of economic growth. The core inequality relation suggests that the capital-to-output ratio (alpha) rises when the real rate of return on capital is persistently higher than the economic growth rate (r>g). Indeed, this process has a positive feedback loop: as the capital-to-output ratio increases, capital owners not only become richer over time, but also reinvest residual capital in the long run. As the real rate of return on capital further exceeds the growth rate of national income, this economic divergence raises beta or the capital-to-income ratio. The higher capital-to-income ratio (beta) further leads to an increase in alpha or the capital-output ratio. Economic inequality persists and even exacerbates in due course. This process generates a broader functional distribution of income in favor of capital. The empirical evidence sheds new light on this economic inequality relation in recent decades.

The second fundamental economic law deals with the long-term capital-to-income ratio (beta). The baseline Solow-Swan economic growth theory suggests that the steady-state capital-output ratio equates the capital investment rate (at which most capital owners save) relative to the rate of economic growth. Most economists can determine the long-term equilibrium capital-income ratios (betas) across countries. This equilibrium condition differs from several economic identities such as the first fundamental law and the inequality relation. In this sense, the second fundamental law of capitalism plays a secondary role in the empirical analysis by Piketty, Saez, and Zucman. The capital-income ratios (betas) settle in the steady state in light of long-run monetary neutrality.

Piketty explains the recent rise of the capital-income ratio (beta) as the result of a persistently high return on capital accumulation in a macro economic environment in favor of capitalists, institutional investors, or entrepreneurs (rather than workers). The evidence lends credence to the same upward movements of the capital-output ratio (alpha) in many OECD countries such as America, Britain, France, Germany, Japan, and Sweden.

Drawing from some literary examples by Jane Austen such as Pride and Prejudice, Piketty shows that it is more important for people to concentrate on family fortune inheritance (instead of hard work and study) in a capitalist society with high returns on capital. The economic trade-off between a lavish lifestyle due to family fortune and a bright career due to hard work and study shines light on economic inequality worldwide. Since the mid-1980s, the dual Thatcher-Reagan economic reforms and revolutions seem to exacerbate this inequality in America, Britain, and many other parts of the world. Piketty interprets this global economic inequality as a pervasive social phenomenon because the real rate of return on capital is persistently higher than the economic growth rate of national income (r>g). In a rather generic sense, this inequality relation has become a ubiquitous scientific fact in most rich countries and some non-OECD countries.

This core interpretation of global capitalism by Piketty, Saez, Zucman, and so forth sharply contrasts with some other reinterpretations of the same economic history in some recent influential books by top economists and economic historians. Some examples include The Wealth and Poverty of Nations by Landes (1999), The Great Escape by Deaton (2013), and Why Nations Fail by Acemoglu and Robinson (2012) etc. For these authors, the post-Industrial-Revolution historical episode represents an eventual enfranchisement of humankind from the short and brutish Malthusian existence. After 2 to 3 thousand years of stagnation, the post-Industrial-Revolution global economic output starts to follow an exponential growth curve. From inclusive institutions to human capital and the effective control of tropical diseases, several ethnic and national groups begin to enjoy the abundant fruits of economic growth. Unlike these authors, however, Piketty focuses on the wider economic divergence between the rich and the poor both across countries and within countries. In sum, inequality arises as a natural result of the first and second fundamental economic laws of capitalism in the modern century. When push comes to shove, the baseline universal law of inadvertent consequences counsels caution.

Most OECD countries now grow at the rate of technological progress (about 1% to 1.5% per year) plus the 1% population growth rate. In this fundamental sense, the nominal economic growth rate (g) cannot exceed 2.5% per year. If the real rate of return on capital remains at its historical rate of 4% to 5% per annum (r>g), several negative social developments arise from pervasive economic inequality worldwide. The distributional effects of r>g tend to be deleterious for the modern society as a whole. This economic trend favors capital owners over labor workers, and further undermines democracy, meritocracy, and equal opportunity worldwide. Piketty can attribute low economic growth to inevitable global development over time as many OECD countries have now reached a relatively high level of national income. The persistently high capital-output ratio (alpha) tends to be the dead hand of the past generation. The persistently high return on capital (r>g) continues to contribute to the inequality relation and so destroys the social fabric of core capitalist economies. The past inequality can inadvertently devour the future world economy.

Some economists expect the marginal return on capital to decrease if the capital-output ratio increases substantially in recent decades. The high persistence of r>g seems to be one weak point of the Piketty economic machinery. Piketty summons a lot of historical evidence to show that the return on capital has been quite stable during the past 2 centuries, despite massive changes in the capital-output ratio. If we go further back into the past Roman times, the return on capital has been quite steady around 5% to 6%. Although many people question financial intermediation and blame financial innovation for the Global Financial Crisis of 2008-2009, Piketty expects this incidence to discover new and productive uses for financial capital. In effect, this asset price discovery helps maintain the real rate of return on capital in the inequality relation of r>g. From a wider perspective, the high persistence of r>g inadvertently exacerbates economic inequality worldwide. In this view, Piketty thus regards the persistently high return on capital as socially undesirable. Piketty then attributes economic inequality to the high elasticity of substitution between capital and labor, and higher returns to top wealth holders due to financial globalization.

In light of both family fortune inheritance and wealth concentration, Piketty argues that we now live in a new era of patrimonial capitalism. This patrimonial capitalism successfully generates higher income and wealth for the top capital owners without the pain of work. The dollar amount of family fortune inheritance as a proportion of national income per year remains 8% to 12% in America, Britain, Canada, France, and Germany over the past 150 years. The upper social echelon can transmit their economic privileges and advantages of top wealth, income, and education etc from one generation to the future generations. To the extent that capital income seems to compound its intrinsic value exponentially over time, patrimonial capitalism can exacerbate the negative ripple effects of economic inequality worldwide.

Piketty indicates that there is an important role for high confiscatory taxation on top wealth worldwide. Imposing high taxes on the top 1% income cohort can generate positive fiscal revenue effects. At the same time, the high taxes on top wealth and capital income can dissuade corporate managers and bankers from asking for the exorbitant salaries. The main role of confiscatory marginal taxation can help garner fiscal revenue. In addition, this taxation on top wealth and capital income can prove to curb political power of the rich.

In a nutshell, many modern capitalist societies where the capital-output ratio is high (and the real rate of return on capital exceeds the economic growth rate) often tend to convert high-skill entrepreneurs into rentiers and rent-seekers. In these societies, it would be illusive for economists to view free market competition as the panacea for top wealth and capital income concentration. Family fortune inheritance serves as the main transmission mechanism for the rich to pass their economic privileges and advantages to the lucky heirs in a less meritocratic world.

Piketty presents his rare unique political economy theory of income concentration. In his view, the key fundamental forces that shape income concentration worldwide are political. These fundamental forces include warfare, taxation, and inflation.

Piketty dismisses the Kuznets classic view of economic inequality: inequality tends to increase at low-income levels, peaks around mid-income levels, and then tends to decline at high-income levels. Piketty cannot find any spontaneous fundamental forces in capitalism that would drive down income inequality on a global scale. Also, Piketty regards the post-war decline in income inequality worldwide as a temporary benign sign of capitalism. Piketty attributes the classic Kuznets view of economic inequality to the optimistic fairy tale that there is light at the end of the tunnel. If the poor modern capitalist economies can choose to follow the Washington consensus policy prescriptions long enough, these economies can experience higher national income, economic growth, and less inequality.

Piketty has revolutionized the economic study of income distribution by the use of fiscal tax data. He focuses on top income shares. The new study contains no single reference to household surveys or Gini coefficients. Specifically, Piketty dismisses the Gini coefficient as an aseptic measure of economic inequality. On the contrary, income shares are intuitive and meaningful. Piketty prefers to split the distribution into 4 parts: the bottom 50%, the next 40%, the top decile, and the top 1% (as part of the top decile). In America, median income has been relatively stagnant in real terms for 40 years, whereas, the top 1% income cohorts have dramatically boosted their share of U.S. income to more than 20%. Piketty, Saez, and Zucman focus on the 99% versus 1% slogan in the political rhetoric of sharp economic inequality in America. Persistent wealth and income concentration can be a real impediment to upward economic mobility in the modern capitalist society.

In addition to the radical economic proposals for basic income and global taxation, Piketty focuses his attention on ubiquitous global taxation on top wealth and capital income. These ambitious and radical policy proposals follow directly from the core concern with the empirical fact that the real rate of return on capital far persistently exceeds the economic growth rate. In a basic view, the only way for politicians to reverse the inequality trend would involve reducing the real rate of return on capital in light of the exogenous economic growth rate. Thus, Piketty, Saez, Zucman, and their co-authors support global taxation on top wealth and capital income.

The empirical analysis of economic inequality done by Piketty, Saez, and Zucman shows the fundamental flaws of a common family fortune inheritance system. This pervasive system favors the capital owners who need not work for their sustenance. Piketty hence proposes fiscal tax modifications on capital. Also, the current taxes on land and inheritance have been long prevalent in global economic history. For this reason, it seems quite reasonable for Piketty to extend this extant taxation to include all forms of capital. Moreover, the technical requirements for global taxation on all forms of capital would overwhelm the administrative agencies worldwide. In practice, it is relatively easy to ascertain the market values of financial instruments, securities, residential properties, and so on as well as the social identities of capital owners worldwide.

The problems are often political. The feasible application of taxation on capital, for instance, can lead to the substantial outflow of capital in America, Britain, France, Germany, Japan, Sweden, and some other rich countries. In this broader context, international collaboration would be indispensable. We cannot expect this cross-country collaboration to arise from the countries that currently benefit substantially from the opacity of financial transactions. Some of these countries even offer tax havens to the rich. Recent U.S. laws and regulations such as the Foreign Account Tax Compliance Act of 2010 serve as the first steps that result in regional taxation of capital.

Piketty has provided a new and extraordinarily rich conceptual framework in regard to the recent rise in economic inequality worldwide. This pervasive inequality trend allows economists to delve into the merits and demerits of high-skill technological progress, trade, and finance etc. The pervasive increase in top wealth and capital income inequality shines new light on the complex nature of modern capitalism.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-17 12:40:00 Monday ET

Nobel Laureate Robert Shiller's long-term stock market indicator points to a recent peak. His cyclically-adjusted P/E ratio (or CAPE) accounts for long-

2019-09-23 12:25:00 Monday ET

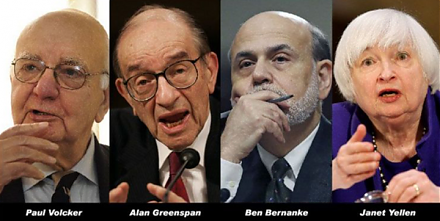

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati

2023-12-08 08:28:00 Friday ET

Tax policy pluralism for addressing special interests Economists often praise as pluralism the interplay of special interest groups in public policy. In

2017-04-01 06:40:00 Saturday ET

With the current interest rate hike, large banks and insurance companies are likely to benefit from higher equity risk premiums and interest rate spreads.

2019-05-21 12:37:00 Tuesday ET

Chicago finance professor Raghuram Rajan shows that free markets need populist support against an unholy alliance of private-sector and state elites. When a