2019-06-07 04:02:05 Fri ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

The world seeks to reduce medicine prices and other health care costs to better regulate big pharma. Nowadays the Trump administration requires pharmaceutical companies to disclose medicine prices in U.S. television ads. Proponents support more transparent disclosures of medicine prices and other health care costs. Yet, other industry groups argue that astronomical medicine prices may inadvertently discourage patients because many specialty medications are not so affordable.

In recent times, the World Health Organization (WHO) discusses universal health care, antimicrobial resistance, and the impact of climate change on global health. A major topic pertains to the high prices of new specialty medicines. For instance, the immuno-oncology medicine Keytruda costs $13,600 per month for continual cancer treatment. Also, the specialty medicine for cystic fibrosis, Orkambi, costs $23,000 per month. In America, many diabetics die primarily due to the high costs of insulin. The Trump administration encourages multinational big pharma firms to reduce medicine prices in America. with healthy price hikes elsewhere, whereas, high health care costs in general, and astronomical specialty medicine prices in particular, remain a widespread problem worldwide. On balance, the government should enforce medicine price reductions to enrich the economic lives of patients around the world.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-19 09:39:00 Tuesday ET

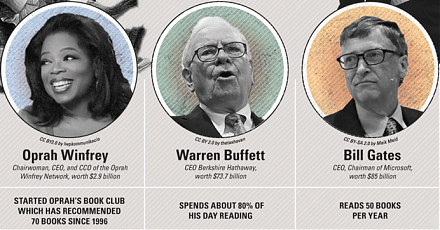

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2020-03-26 10:31:00 Thursday ET

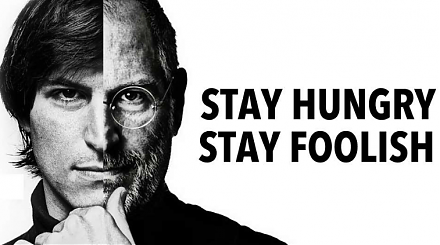

The unique controversial management style of Steve Jobs helps translate his business acumen into smart product development. Jay Elliot (2012) Leading

2022-09-25 09:34:00 Sunday ET

Main reasons for share repurchases Temporary market undervaluation often induces corporate incumbents to initiate a share repurchase program to boost the

2018-07-03 11:42:00 Tuesday ET

President Trump's current trade policies appear like the Reagan administration's protectionist trade policies back in the 1980s. In comparison to th

2018-08-09 16:36:00 Thursday ET

President Trump applies an increasingly bellicose stance toward the Iranian leader Hassan Rouhani as he rejects a global agreement to curb Iran's nuclea

2017-11-13 07:42:00 Monday ET

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin