2018-01-06 07:32:00 Sat ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Subsequent to the Trump tax cuts for Christmas in December 2017, the one-year-old Trump presidency now aims to make progress on health care, infrastructure, social welfare, and immigration in 2018. First, President Trump proposes to repeal-and-replace Obamacare in due course. He also seeks to reduce drug prices and other medical costs for the typical American. Second, the Trump team proposes $1 trillion infrastructure investments in numerous major American states and cities. This campaign promise serves the best interests of workers with less educational attainment and more labor intensity. Third, the Trump administration seeks to roll out an executive order to mandate a holistic review of federal safety net programs. These programs encompass food stamps, Medicaid incentives, and residential housing benefits etc. Fourth, President Trump keeps an ambivalent attitude toward immigration issues such as illegal immigrant deportation and foreign child deferral. All this government intervention helps alleviate social welfare concerns. From an economic perspective, it is a bit difficult to see how the Trump administration can fund these reforms without some form of fiscal discipline. In the next few years, tax cuts trump trade, whereas U.S. real GDP economic growth has to rise to 3%-3.5% for fiscal stimulus to trickle down to the typical American household.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-24 14:38:00 Saturday ET

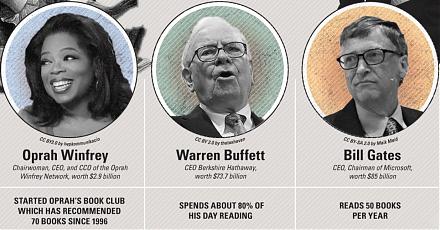

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2017-02-07 07:47:00 Tuesday ET

With prescient clairvoyance, Bill Gates predicted the recent sustainable rise of Netflix and Facebook during a Playboy interview back in 1994. He said th

2019-07-11 10:48:00 Thursday ET

France and Germany are the biggest beneficiaries of Sino-U.S. trade escalation, whereas, Japan, South Korea, and Taiwan suffer from the current trade stando

2018-03-19 10:37:00 Monday ET

Uber's autonomous car causes the first known pedestrian fatality from a driverless vehicle and thus sets off the alarm bell for artificial intelligence.

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma