2017-05-07 06:39:00 Sun ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

While the original five-factor asset pricing model arises from a quasi-lifetime of top empirical research by Nobel Laureate Eugene Fama and his long-time co-author Kenneth French, the sixth factor is hypothetical in nature and stems from bullish-versus-bearish investor sentiment on social media.

In addition to the conventional fundamental factors such as size, value, market risk, operating profitability, and asset growth, the social media factor serves as a new measure of investor sentiment.

All these factors help explain the time-series variation in most U.S. stock returns relative to the risk-free rate.

Whether this additional social media factor represents exposure to systematic risk remains a debatable controversy because there is now minimal consensus on this open issue.

Several financial economists recommend raising the empirical hurdle for novel fundamental factors such as this social media measure of investor sentiment.

On balance, it is informative for most stock market investors to recognize that social media conveys pivotal information about at least part of the time variation in the vast majority of U.S. stock portfolio returns ceteris paribus.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-09 08:44:00 Sunday ET

President Trump meets with Chinese President Xi again at the G20 summit in the city of Buenos Aires, Argentina, in late-November 2018. President Donald Trum

2018-10-23 12:36:00 Tuesday ET

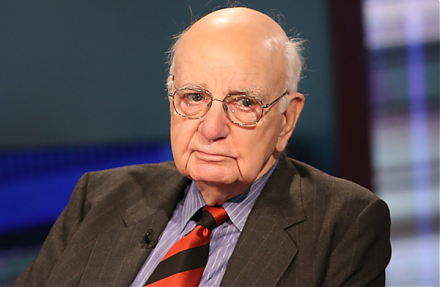

Former Fed Chair Paul Volcker releases his memoir, talks about American public governance, and worries about plutocracy in America. Volcker suggests that pu

2018-01-29 07:38:00 Monday ET

President Donald Trump delivers his first state-of-the-union address. Several key highlights touch on economic issues from fiscal stimulus and trade protect

2023-04-07 12:29:00 Friday ET

Timothy Geithner shares his reflections on the post-crisis macro financial stress tests for U.S. banks. Timothy Geithner (2014) Macrofinanci

2020-09-17 12:28:00 Thursday ET

Many successful business organizations develop their distinctive capabilities and unique value propositions for strategic reasons. Paul Leinwand and Cesa

2018-01-05 07:37:00 Friday ET

Warren Buffett cleverly points out that American children will not only be better off than their parents, but the former will also enjoy higher living stand