2017-05-07 06:39:00 Sun ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

While the original five-factor asset pricing model arises from a quasi-lifetime of top empirical research by Nobel Laureate Eugene Fama and his long-time co-author Kenneth French, the sixth factor is hypothetical in nature and stems from bullish-versus-bearish investor sentiment on social media.

In addition to the conventional fundamental factors such as size, value, market risk, operating profitability, and asset growth, the social media factor serves as a new measure of investor sentiment.

All these factors help explain the time-series variation in most U.S. stock returns relative to the risk-free rate.

Whether this additional social media factor represents exposure to systematic risk remains a debatable controversy because there is now minimal consensus on this open issue.

Several financial economists recommend raising the empirical hurdle for novel fundamental factors such as this social media measure of investor sentiment.

On balance, it is informative for most stock market investors to recognize that social media conveys pivotal information about at least part of the time variation in the vast majority of U.S. stock portfolio returns ceteris paribus.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-25 13:34:00 Friday ET

Netflix raises its prices by 13% to 18% for U.S. subscribers. The immediate stock market price soars 6.5% as a result of this upward price adjustment. The b

2018-01-04 07:36:00 Thursday ET

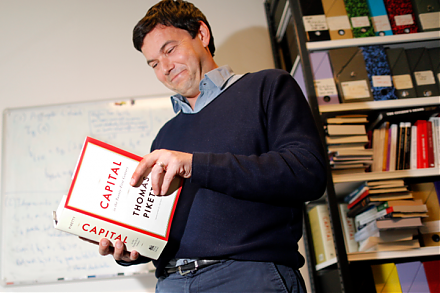

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2025-10-01 10:29:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2019-04-05 08:25:00 Friday ET

Warren Buffett places his $58 billion stock bets on Apple, American Express, and Goldman Sachs. Berkshire Hathaway owns $18 billion equity stakes in America

2018-03-23 08:26:00 Friday ET

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai