2019-05-15 12:32:00 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administration at least 3 times, the E.U. agrees to the subsequent May request of a long extension of Brexit to late-October 2019. The Brexit bill or withdrawal agreement may involve a gross amount of €100 billion. Net of some U.K. assets, the final bill would involve about €55 billion to €75 billion. The key withdrawal transfer funds can contribute to better British health care, social welfare, infrastructure, taxation, and other aspects of public finance. In the prior Brexit referendum, supportive sentiments arise from a wide variety of socioeconomic factors such as the European sovereign debt crisis, immigration, terrorism, and E.U. bureaucracy. Also, Britons primarily use the British pound, so the U.K. has never been part of the E.U. monetary union.

However, Brexit may be detrimental to cross-border trade for the U.K. because the Eurozone remains the primary trade bloc to the country. When the European Union affirms a long extension to Halloween Brexit, the U.K. prime minister Theresa May either gives up her public governance role or seeks a fresh fallback option.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2021-05-20 10:30:00 Thursday ET

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology. Core trade technological advances and disruptive

2019-01-01 03:34:48 Tuesday ET

American allies assist AT&T and Verizon in implementing 5G telecommunication technology in the U.S. as such allies ban the use of HuaWei 5G telecom equi

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an

2018-12-07 11:35:00 Friday ET

Fed Chair Jerome Powell hints slower interest rate increases because the current rate is just below the neutral threshold. NYSE and NASDAQ share prices rebo

2017-11-13 07:42:00 Monday ET

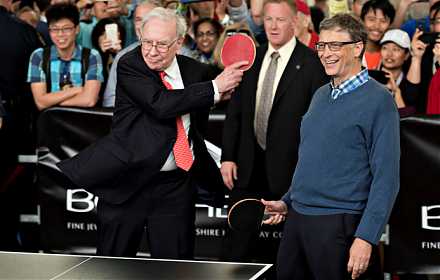

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2019-09-05 09:26:00 Thursday ET

Yale macro economist Stephen Roach draws 3 major conclusions with respect to the Chinese long-run view of the current tech trade conflict with America. Firs