2019-05-15 12:32:00 Wed ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administration at least 3 times, the E.U. agrees to the subsequent May request of a long extension of Brexit to late-October 2019. The Brexit bill or withdrawal agreement may involve a gross amount of €100 billion. Net of some U.K. assets, the final bill would involve about €55 billion to €75 billion. The key withdrawal transfer funds can contribute to better British health care, social welfare, infrastructure, taxation, and other aspects of public finance. In the prior Brexit referendum, supportive sentiments arise from a wide variety of socioeconomic factors such as the European sovereign debt crisis, immigration, terrorism, and E.U. bureaucracy. Also, Britons primarily use the British pound, so the U.K. has never been part of the E.U. monetary union.

However, Brexit may be detrimental to cross-border trade for the U.K. because the Eurozone remains the primary trade bloc to the country. When the European Union affirms a long extension to Halloween Brexit, the U.K. prime minister Theresa May either gives up her public governance role or seeks a fresh fallback option.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-12-01 11:37:00 Saturday ET

As the solo author of the books Millionaire Next Door and Richer Than Millionaire, William Danko shares 3 top secrets for *better wealth creation*. True pro

2019-08-20 07:33:00 Tuesday ET

The recent British pound depreciation is a big Brexit barometer. Britain appoints former London mayor and Foreign Secretary Boris Johnson as the prime minis

2018-03-03 11:37:00 Saturday ET

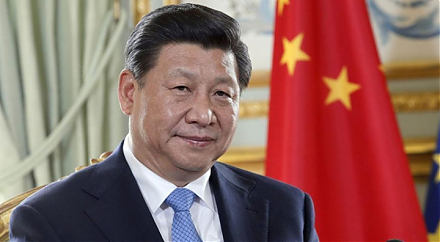

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies

2017-04-19 17:37:00 Wednesday ET

Apple is now the world's biggest dividend payer with its $13 billion dividend payout and surpasses ExxonMobil's dividend payout record. Despite the