2019-06-23 08:30:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare. Ages 22 to 39, millennials have less purchasing power than previous generations did at the same age. Although millennials have benefited from a 67% increase in real wages since the 1970s, this wage boost is insufficient for millennials to keep up with CPI price inflation over the past 4 decades. More than half of millennials cannot afford to own residential properties, have less than $5,000 in their bank deposit accounts, and maintain no retirement accounts. Nowadays millennial affordability attracts both public and private solutions.

For instance, Senator Elizabeth Warren proposes that the government forgives $50,000 in student loan debt for each American whose family earns up to $100,000. Also, Former Vice President Joe Biden supports the new proposal that it should be free for students to complete 4-year bachelor degrees at public universities and colleges. Moreover, the venture fund Kairos invests in more than 5 companies with $20 million to design solutions that tackle the inflationary costs of student loan debt, residential demand, childcare, health insurance, and so forth. Overall, millennial affordability has hence become a major socioeconomic issue in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-03 08:37:00 Sunday ET

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook explo

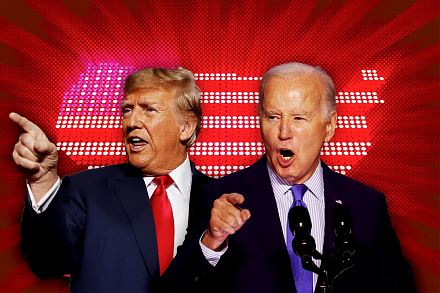

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2018-09-09 13:42:00 Sunday ET

Warren Buffett shares his key insights into life, success, money, and interpersonal communication. Institutional money managers and retail investors ca

2019-04-13 14:28:00 Saturday ET

Saudi Aramco unveils the financial secrets of the most profitable corporation in the world. In its recent public bond issuance prospectus, Aramco offers the

2016-10-19 00:00:00 Wednesday ET

India's equivalent to Warren Buffett in America, Rakesh Jhunjhunwala, offers several key lessons for stock market investors: When the press o

2026-02-28 10:29:00 Saturday ET

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors. As of March 2026, we have up