2019-06-23 08:30:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare. Ages 22 to 39, millennials have less purchasing power than previous generations did at the same age. Although millennials have benefited from a 67% increase in real wages since the 1970s, this wage boost is insufficient for millennials to keep up with CPI price inflation over the past 4 decades. More than half of millennials cannot afford to own residential properties, have less than $5,000 in their bank deposit accounts, and maintain no retirement accounts. Nowadays millennial affordability attracts both public and private solutions.

For instance, Senator Elizabeth Warren proposes that the government forgives $50,000 in student loan debt for each American whose family earns up to $100,000. Also, Former Vice President Joe Biden supports the new proposal that it should be free for students to complete 4-year bachelor degrees at public universities and colleges. Moreover, the venture fund Kairos invests in more than 5 companies with $20 million to design solutions that tackle the inflationary costs of student loan debt, residential demand, childcare, health insurance, and so forth. Overall, millennial affordability has hence become a major socioeconomic issue in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-15 13:36:00 Friday ET

CNBC stock host Jim Cramer recommends both Caterpillar and Home Depot as the U.S. bull market is likely to continue in light of the recent Fed Chair comment

2018-06-05 07:36:00 Tuesday ET

Just Capital issues a new report in support of the stakeholder value proposition in recent times. U.S. corporations that perform best on key priorities such

2018-01-21 07:25:00 Sunday ET

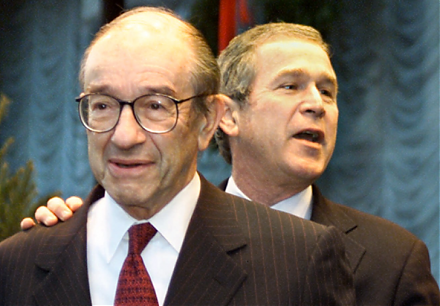

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2019-10-09 16:46:00 Wednesday ET

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form

2023-12-04 12:30:00 Monday ET

Bank leverage and capital bias adjustment through the macroeconomic cycle Abstract We assess the quantitative effects of the recent proposal

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins