2018-09-07 07:33:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

The Economist re-evaluates the realistic scenario that the world has learned few lessons of the global financial crisis from 2008 to 2009 over the past decade. Good times breed complacency. As the Trump administration rolls back key Dodd-Frank rules and regulations, the Federal Reserve has yet to raise countercyclical capital buffers for most banks. When prudence prevails, no regulator is a perfect judge of financial risk.

The Economist points out that the current news is both good and bad. The good news suggests that most U.S. large banks finance themselves with proportionately more equity. The average bank equity capital ratio increases substantially from 3% to double digits in the decade after the Lehman financial meltdown.

However, the bad news suggests that most U.S. households, firms, and financial intermediaries react slowly to the U.S. subprime mortgage crisis from 2008 to 2009.

Former U.S. Treasury Secretary and Harvard President Larry Summers shares his ingenious insight that the U.S. economy suffers secular stagnation, government debt, and inflation in the recent decade after the global financial crisis. In light of gradual greenback appreciation and national populism, Harvard chair professor Kenneth Rogoff indicates that the Trump stock market rally may be the calm before the next financial storm.

Despite hefty Trump tax cuts and infrastructure expenditures, the U.S. economy operates near full employment with high inflation, currency, and interest rate risks. This trifecta poses a red alert to the Trump administration and its advisory troika (National Economic Council, Federal Reserve, and Treasury).

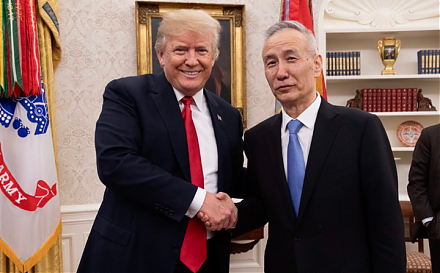

Both the U.S. Treasury and National Economic Council favor imposing draconian tariffs on at least $200 trillion Chinese imports. This trade tactic aims to help curtail bilateral trade deficits with China. These tariffs may affect Canada, Europe, Mexico, and Japan.

Moreover, the Federal Reserve accelerates the current interest rate hike (with at least one rate increase in September 2018 and another in December 2018). This hawkish interest rate hike is likely to continue until late-2019. All of these fiscal and monetary measures can help contain the high-risk trifecta of inflation, fiscal debt and deficit, and secular stagnation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on

2022-05-15 10:29:00 Sunday ET

Innovative investment theory and practice Corporate investment can be in the form of real tangible investment or intangible investment. The former conce

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2023-04-28 16:38:00 Friday ET

Peter Schuck analyzes U.S. government failures and structural problems in light of both institutions and incentives. Peter Schuck (2015) Why

2018-10-17 12:33:00 Wednesday ET

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin

2017-01-27 17:19:00 Friday ET

Tony Robbins explains in his latest book on personal finance that *patience* is the top secret to successful stock investment. The stock market embeds an