2019-01-17 10:41:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and European stock markets reap sharp gains primarily due to cautious optimism over the results of complete trade negotiations between China and America. In this new light, stock market analysts view these trade talks as serious and productive because these talks extend to the third day with some concrete trade war resolution. The 3-day trade negotiations between mid-level Sino-U.S. senior reps end on a positive note and also help clear the way for subsequent higher-level trade talks. All these joint effects aim to avert any further major escalation of the Sino-American trade war in early-March 2019.

The Xi administration pledges to buy more U.S. goods and also seeks to improve the best practices on Chinese intellectual property protection. The trade talks can help reduce the Sino-American trade deficit by a substantial dollar amount. In turn, the Trump team emphasizes the clear intention to ensure Chinese compliance with *continual verification and effective enforcement*. Thus, the Trump administration continues to restrict Chinese investments in critical technology transfers from U.S. tech titans such as Apple, Amazon, Google, Intel, Microsoft, and Qualcomm etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-01-03 03:26:00 Tuesday ET

President-Elect Donald Trump wants Apple and its tech peers to consider better and greater high-tech job creation in America. Apple has asked its primary

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2018-01-23 06:38:00 Tuesday ET

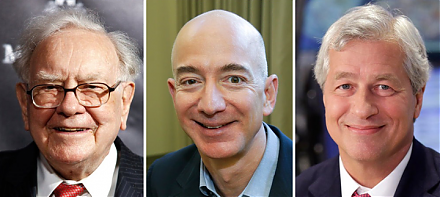

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2018-11-07 08:30:00 Wednesday ET

PwC releases a new study of top innovators worldwide as of November 2018. This study assesses the top 1,000 global companies that spend the most on R&D

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out

2018-11-21 11:36:00 Wednesday ET

Apple upstream suppliers from Foxconn and Pegatron to Radiance and Lumentum experience sharp share price declines during the Christmas 2017 holiday quarter.