2019-01-17 10:41:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and European stock markets reap sharp gains primarily due to cautious optimism over the results of complete trade negotiations between China and America. In this new light, stock market analysts view these trade talks as serious and productive because these talks extend to the third day with some concrete trade war resolution. The 3-day trade negotiations between mid-level Sino-U.S. senior reps end on a positive note and also help clear the way for subsequent higher-level trade talks. All these joint effects aim to avert any further major escalation of the Sino-American trade war in early-March 2019.

The Xi administration pledges to buy more U.S. goods and also seeks to improve the best practices on Chinese intellectual property protection. The trade talks can help reduce the Sino-American trade deficit by a substantial dollar amount. In turn, the Trump team emphasizes the clear intention to ensure Chinese compliance with *continual verification and effective enforcement*. Thus, the Trump administration continues to restrict Chinese investments in critical technology transfers from U.S. tech titans such as Apple, Amazon, Google, Intel, Microsoft, and Qualcomm etc.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

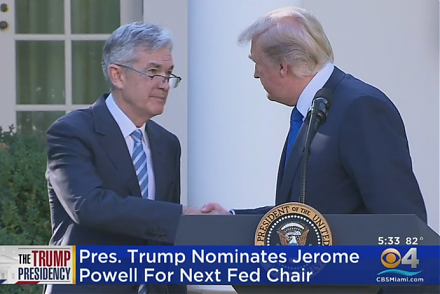

2017-10-03 18:39:00 Tuesday ET

President Trump has nominated Jerome Powell to run the Federal Reserve once Fed Chair Janet Yellen's current term expires in February 2018. Trump's

2019-04-03 11:35:00 Wednesday ET

A Florida fintech group Fidelity Information Services initiates the largest $43 billion acquisition of the e-commerce payments processor Worldpay. Fidelity

2018-02-19 08:39:00 Monday ET

Snap cannot keep up with the Kardashians because its stock loses market value 7% or $1 billion after Kylie Jenner tweets about her decision to leave Snapcha

2018-01-07 09:33:00 Sunday ET

Zuckerberg announces his major changes in Facebook's newsfeed algorithm and user authentication. Facebook now has to change the newsfeed filter to prior

2018-05-17 07:41:00 Thursday ET

Has America become a democratic free land of crumbling infrastructure, galloping income inequality, bitter political polarization, and dysfunctional governa

2020-06-17 09:23:00 Wednesday ET

Successful founders focus on their continuous growth, passion, perseverance, and the collective wisdom of most team members. William Ferguson (2013) &