2017-08-13 09:36:00 Sun ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Several investors and billionaires such as George Soros, Warren Buffett, Carl Icahn, and Howard Marks suggest that the time may be ripe for a major financial market correction. The recent optimistic Trump rally has catapulted stock and bond prices by a 20% margin. This stock and bond market overvaluation seems to be a natural result of President Trump's generous pro-growth fiscal stimulus trifecta of lower income taxation, financial deregulation, and new infrastructure with corporate offshore cash repatriation. Whether the current Trump financial market rally can deliver tangible economic gains depends on the eventual GDP growth trajectory toward the target range of 2.7% to 3.3% per annum.

During the current interest rate hike, we expect most stock and bond prices to moderately react to monetary contraction and self-fulfilling prophecy in a soft downward path. This new normal scenario does not necessarily correspond to secular stagnation in the precise words of Larry Summers and others. However, it is reasonable to anticipate a reasonable financial market correction in light of the recent nuclear standoff between America and North Korea, U.S. monetary contraction, and Trump trade conservatism. Overall, geopolitical risk remains the primary source of economic uncertainty as the Trump administration seeks to maintain a delicate balance between these undercurrents for better business growth and financial stability.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-12-01 06:30:00 Friday ET

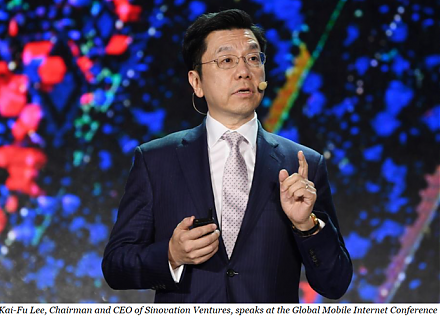

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2018-04-17 12:38:00 Tuesday ET

Value investment strategies make investors wiser like water with core fundamental factor analysis. Value investors tend to buy stocks below their intrinsic

2024-03-26 09:30:00 Tuesday ET

Stock Synopsis: ESG value and momentum stock market portfolio strategies Since 2013, we have been delving into the broad topics of ESG (Environmental, So

2020-07-05 11:31:00 Sunday ET

Business entrepreneurs dare to dream, remain true and authentic to themselves, and try to make a great social impact in the world. Alex Malley (2014)

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2019-07-15 16:37:00 Monday ET

President of US-China Business Council Craig Allen states that a trade deal should be within reach if Trump and Xi show courage at G20. A landmark trade agr