2018-10-30 10:41:00 Tue ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Personal finance author Ramit Sethi suggests that it is important to invest in long-term gains instead of paying attention to daily dips and trends. It is futile to time the stock market. Wild and unpredictable fluctuations can confuse stock investors who miss informative fundamental factors from time to time.

Investors should play the long game by spending a sufficient amount of time in small-to-mid-cap profitable value stocks that exhibit conservative capital investment. This value investment strategy yields an 8% stock market return net of inflation on average.

If the investor stays in the U.S. stock market with his or her $10,000 investment during the 20-year sample period from 1998 to 2017, the long-run S&P 500 average return is 7.2%. However, if the investor misses the top 10 days of hefty stock market gains, he or she earns only 3.5%.

For this reason, rational investors should aim to persist throughout transient stock market ebbs and flows for sustainable shareholder value maximization. Long-term stock market returns consistently conform to the normal distribution with fat tails or leptokurtic extreme outliers. Insofar as the investor can persevere in his or her multi-year value investment strategy, this strategy helps reap reasonable rewards in due course.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-05 11:39:00 Saturday ET

Reuters polls show that most Americans blame President Trump for the recent U.S. government shutdown. President Trump remains adamant about having to shut d

2022-05-15 10:29:00 Sunday ET

Innovative investment theory and practice Corporate investment can be in the form of real tangible investment or intangible investment. The former conce

2017-03-15 08:46:00 Wednesday ET

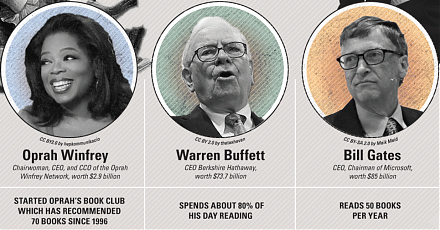

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creatio

2023-12-04 12:30:00 Monday ET

Bank leverage and capital bias adjustment through the macroeconomic cycle Abstract We assess the quantitative effects of the recent proposal

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2020-07-19 09:25:00 Sunday ET

Senior business leaders can learn much from the lean production system with iterative continuous improvements at Toyota. Takehiko Harada (2015)