2019-05-21 12:37:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

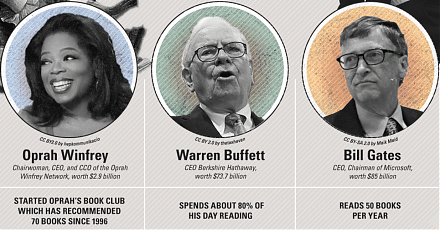

Chicago finance professor Raghuram Rajan shows that free markets need populist support against an unholy alliance of private-sector and state elites. When a few corporations dominate the U.S. economy, this oligopoly inevitably teams up with the primary instruments of state control for greater rent protection, political clout, and economic power concentration. Regulatory efforts should thus strike a delicate balance between legitimate antitrust scrutiny and capitalist productivity. In the post-modern era of global supply chains, American corporations benefit from enormous economies of scale and scope, network effects, and real-time data analytics for continual efficiency gains and performance improvements.

For instance, Amazon uses fast algorithms to learn from its internal real-time data to optimize delivery times, retail prices, and customer services etc; Facebook and Google applies artificial intelligence to optimize the dual-platform experiences of both mobile web users and advertisers; Apple monopolizes iOS app usage on its proprietary App Store online marketplace. These oligopolies often leverage their market power to charge higher mark-ups to the detriment of active users worldwide. Despite these key anticompetitive practices, the right regulatory response requires rebalancing the current oligopolistic industries to promote meaningful competition. U.S. capitalism needs bottom-up populist reforms and democratic communities to preserve trust in the vibrant market economy.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-11-17 14:43:00 Sunday ET

New computer algorithms and passive mutual fund managers run the stock market. Morningstar suggests that the total dollar amount of passive equity assets re

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

2022-10-25 11:31:00 Tuesday ET

Corporate investment insights from mergers and acquisitions Relative market misvaluation between the bidder and target firms drives most waves of mergers

2022-04-05 17:39:00 Tuesday ET

Corporate diversification theory and evidence A recent strand of corporate diversification literature spans at least three generations. The first generat

2019-09-30 07:33:00 Monday ET

AYA Analytica finbuzz podcast channel on YouTube September 2019 In this podcast, we discuss several topical issues as of September 2019: (1) Former

2019-07-05 09:32:00 Friday ET

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilitie