2018-08-17 11:45:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statements, and cash flow statements once per quarter. President Trump tweets that he now asks the U.S. Securities and Exchange Commission (SEC) to investigate the practical implications of switching to a semi-annual corporate disclosure cycle. Specifically, the Trump administration seeks an SEC study of semi-annual income statements instead of quarter-to-quarter financial reports for U.S. public corporations. Several CEOs such as JPMorgan Chase's Jamie Dimon and Berkshire Hathaway's Warren Buffett support this paradigm shift toward longer-term corporate investment focus rather than short-termism. When Wall Street stock analysts continue to fixate on quarter-to-quarter EPS and sales growth forecasts, U.S. public corporations may fail to deliver long-term gains in the form of better R&D innovation, technology, and greater financial inclusion.

However, some stock market investors and activists may balk at the likely opaque disclosure of U.S. corporate financial performance. The resultant deterioration in corporate transparency can induce U.S. public corporations to derail off the current path of consistent stakeholder communication. Indeed, both the Trump tweet and subsequent SEC investigation seem to resonate with Democrat Senator Elizabeth Warren's recent proposal or the Accountable Capitalism Act.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-07-27 10:35:00 Friday ET

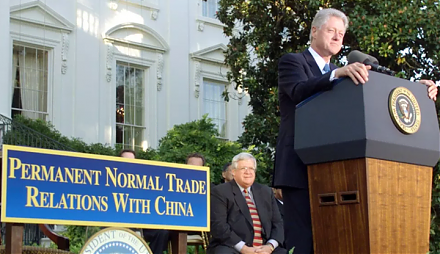

Admitting China to the World Trade Organization (WTO) and other international activities seems ineffective in imparting economic freedom and democracy to th

2020-09-03 10:26:00 Thursday ET

Agile business firms beat the odds by building faster institutional reflexes to anticipate plausible economic scenarios. Christopher Worley, Thomas Willi

2017-12-03 08:37:00 Sunday ET

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook explo

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo

2016-11-09 00:00:00 Wednesday ET

Universally dismissed as a vanity presidential candidate when he entered a field crowded with Republican talent, the former Democrat and former Independent

2019-04-23 19:45:00 Tuesday ET

Income and wealth concentration follows the ebbs and flows of the business cycle in America. Economic inequality not only grows among people, but it also gr