2018-09-11 18:36:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump tweets that Apple can avoid tariff consequences by shifting its primary supply chain from China to America. These Trump tariffs on another $200 billion Chinese goods can affect iPhone, Apple Watch, and AirPods and adapters and chargers for a major host of iOS products. These tariffs can in turn raise prices for Apple consumers.

An Apple upstream supplier Foxconn moonlights new U.S. plant sites in addition to its recent liquid crystal display (LCD) plant establishment in Wisconsin. However, Foxconn and other Apple upstream suppliers still need to mull over whether it is sufficiently profitable to open new plants for AMOLED touch screens in America.

In a recent interview with CNBC news anchor Becky Quick, Berkshire Hathaway's Warren Buffett shares his view that many market watchers seem to underprice iPhone X [and its sequels]. In a recent press release, Apple raises the retail prices of iPhone Xs, iPhone Xs Max, and iPhone XR with higher-pixel camera resolution, longer battery life, and better digital storage.

In accordance with Apple CEO Tim Cook's prescient prediction, the Trump steel-and-aluminum tariffs may impact both the iPhone and iPad product lines when the Trump administration activates punitive tariffs on $200 billion Chinese imports.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-05-01 09:45:00 Monday ET

Apple now pursues an early harvest strategy that focuses on extracting healthy profits from a relatively static market for the Mac, iPhone, and iPad, all of

2019-09-07 17:37:00 Saturday ET

Federal Reserve Chair Jerome Powell announces the monetary policy decision to lower the federal funds rate by a quarter point to 2%-2.25%. This interest rat

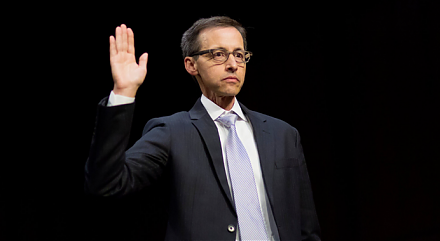

2017-09-19 05:34:00 Tuesday ET

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2019-06-29 17:30:00 Saturday ET

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, socia

2018-12-18 10:38:00 Tuesday ET

President Trump threatens to shut down the U.S. government in 2019 if Democrats refuse to help approve $5 billion public finance for the southern border wal