2018-05-07 07:32:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

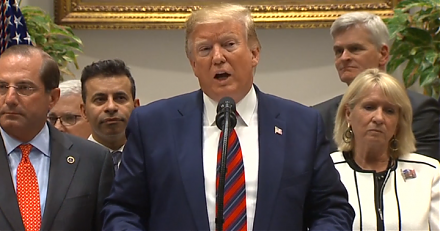

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Britain, France, Germany, Japan, and South Korea. As of early-2018, the typical American spends more than $1,100 on prescription drugs per year.

It is true that many Americans take pills on a regular basis, but what sets the U.S. apart from most other OECD countries relates to high drug prices. President Trump now attempts to induce large pharmaceutical companies such as Merck, Johnson & Johnson, Pfizer, Amgen, and GSK etc to increase their medicine prices abroad. This strategic move would create economic incentives for these companies to cut drug prices in America. In light of the high health insurance and medical costs in America, the Trump administration either has to foster competition among biotech firms and pharmaceutical companies, or the Trump administration needs to induce them to voluntarily reduce medicine prices.

President Trump sometimes retorts with the deliberate hyperbole that drugmakers can **get away with murder** in what they charge the government for medication. As the American population enjoys longer human longevity with better medical technology, lower medicine prices seem to have become a necessary evil for big pharma.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-01 07:30:00 Friday ET

The U.S. federal government debt has risen from less than 40% of total GDP about a decade ago to 78% as of May 2018. The Congressional Budget Office predict

2019-09-01 10:31:00 Sunday ET

Most artificial intelligence applications cannot figure out the intricate nuances of natural language and facial recognition. These intricate nuances repres

2022-02-25 00:00:00 Friday ET

Empirical tests of multi-factor models for asset return prediction The capital asset pricing model (CAPM) of Sharpe (1964), Lintner (1965), and Bla

2021-08-01 07:26:00 Sunday ET

The Biden administration launches economic reforms in fiscal and monetary stimulus, global trade, finance, and technology. President Joe Biden proposes s

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr

2018-09-23 08:37:00 Sunday ET

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank ca