2019-02-05 10:32:00 Tue ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

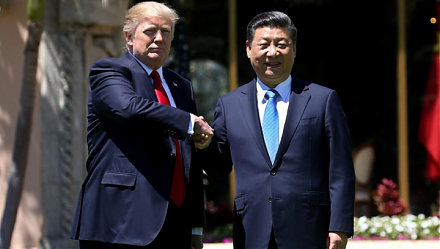

President Trump remains optimistic about the Sino-American trade war resolution of both trade deficit eradication and tech transfer enforcement. Trump now seeks to enact new economic sanctions with 25% tariffs on Chinese goods and services if the Chinese Xi administration cannot agree to help reduce the U.S. $375 billion bilateral trade deficit. President Trump suggests a handshake deal instead of a firmer trade agreement when he meets President Xi soon after the second summit between Trump and the North Korean leader Kim Jung-Un in Vietnam in February 2019. The Trump trade team continues to be optimistic about the next Sino-U.S. trade war resolution of both better trade balance and tech transfer enforcement.

Trump economic advisors indicate that it is easier for China to buy more American products such as soybeans, cars, and airplanes etc in order to reduce the current Sino-U.S. trade imbalance. However, it can be difficult for the Trump administration to strictly enforce complete, verifiable, and irreversible protection of core American intellectual properties such as patents and trademarks. The latter chronic problem persists for many years because it is virtually impossible for the U.S. government to meter unfair intellectual property usage and infringement by Chinese tech firms such as HuaWei.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-25 12:41:00 Monday ET

Chicago financial economist Raghuram Rajan views communities as the third pillar of liberal democracy in addition to open markets and states. Rajan suggests

2018-11-15 12:35:00 Thursday ET

Warren Buffett approves Berkshire Hathaway to implement new meaningful stock repurchases. Buffett sends a positive signal to the stock market with the Berks

2019-04-23 19:45:00 Tuesday ET

Income and wealth concentration follows the ebbs and flows of the business cycle in America. Economic inequality not only grows among people, but it also gr

2018-10-11 08:44:00 Thursday ET

Treasury bond yield curve inversion often signals the next economic recession in America. In fact, U.S. bond yield curve inversion correctly predicts the da

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2019-05-01 09:27:00 Wednesday ET

Apple settles its 2-year intellectual property lawsuit with Qualcomm by agreeing to a multi-year patent license with royalty payments to the microchip maker