2017-11-05 09:45:00 Sun ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump criticizes the potential media merger between AT&T and Time Warner, the latter of which owns the anti-Trump media network CNN. President Trump thinks this deal is "not good for the country" because consumers would have to pay more with serious and rampant antitrust concerns. In recent times, Justice Department has sued to block AT&T's $85.3 billion bid for Time Warner. This lawsuit sets up a showdown over a blockbuster acquisition that the Trump administration deems to weaken competition in the capricious media landscape.

This legal battle differs starkly from the Obama administration's approval of a similar deal by Comcast to acquire NBC Universal Media in 2011. If AT&T's bid for Time Warner were to proceed, the merger would create a media and tele-communication behemoth. With its 2015 acquisition of the largest U.S. satellite company DirecTV, AT&T became the largest television distribution in America. Should AT&T be able to acquire Time Warner, the joint company would possess a non-rivalrous capability to reach consumers through news and entertainment programs with Time Warner's unique content distribution of Games of Thrones, Wonder Woman, Harry Potter, CNN news, TNT sports, and so forth. The law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-09-19 05:34:00 Tuesday ET

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2018-02-11 07:30:00 Sunday ET

President Trump unveils his ambitious $1.5 trillion public infrastructure plan. Trump proposes offering $100 billion in federal incentives to encourage stat

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-03-27 11:28:00 Wednesday ET

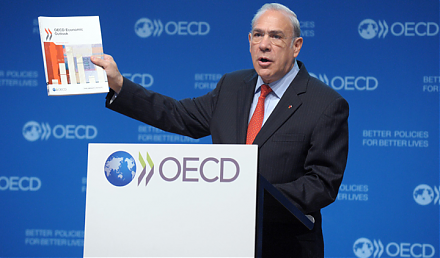

OECD cuts the global economic growth forecast from 3.5% to 3.3% for the current fiscal year 2019-2020. The global economy suffers from economic protraction

2019-10-31 13:38:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube October 2019 In this podcast, we discuss several topical issues as of October 2019: (1)

2018-11-11 13:42:00 Sunday ET

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears