2018-01-29 07:38:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

President Donald Trump delivers his first state-of-the-union address. Several key highlights touch on economic issues from fiscal stimulus and trade protectionism to infrastructure, immigration, and social security. The hefty Trump tax cuts provide tremendous relief for the middle-class Americans and small businesses. About 3 million American workers receive tax incentives primarily due to this legislative win for the Trump administration and Republican-driven Congress.

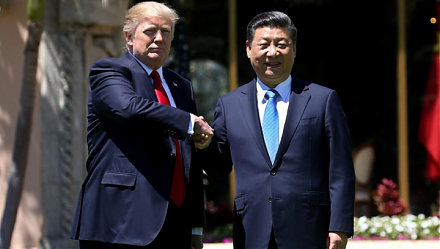

When the U.S. Trade Act Section 301 investigation concludes in due course, the Trump administration expects to escalate tariffs, quotas, and even embargoes on Chinese imports. These tariffs and other trade barriers effectively penalize China for perennial patent, trademark, and copyright infringement and other intellectual property theft. This trade protectionism helps eradicate hefty U.S. trade deficits to the detriment of China and western allies such as Canada, Europe, and Mexico.

Trump now urges Congress to pass fresh legislation to replenish $1.5 trillion U.S. modern infrastructure with new roads, bridges, highways, railways, and waterways. Also, the Trump administration designs new immigration policies with better border control to circumvent drugs, gangs, and other criminal activities that plaque many U.S. immigrant communities.

Finally, President Trump now considers foreign investment restrictions in defense of national security from LTE broadband technology to 5G telecommunication. All these economic reforms help ensure sustainable economic prosperity in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-05-15 10:29:00 Sunday ET

Innovative investment theory and practice Corporate investment can be in the form of real tangible investment or intangible investment. The former conce

2023-05-27 11:30:00 Saturday ET

Bank failure resolution and financial risk management: Silicon Valley Bank, Signature Bank, and First Republic Bank. What are the main root cau

2017-01-17 12:42:00 Tuesday ET

Former Treasury Secretary and Harvard President Larry Summers critiques that the Trump administration's generous tax holiday for American multinational

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2019-05-05 10:34:00 Sunday ET

Former Vice President Joe Biden enters the next U.S. presidential race with many moderate-to-progressive policy proposals. At the age of 76, Biden stands ou