2017-08-19 14:43:00 Sat ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

In a recent tweet, President Donald Trump criticizes Amazon over taxes and jobs. Without providing specific evidence, Trump accuses of the e-commerce retailer of hurting U.S. cities and states with job losses. Amazon's stock price declines quite a bit after this tweet. In his critique, Trump has targeted Amazon whose CEO Jeff Bezos owns the Washington Post, one of several major media outlets that have been swept up in the president's relentless fight with the press.

Now stock analysts and market observers wait for Treasury Secretary Steve Mnuchin to deliver on Trump's promise of a comprehensive fiscal overhaul with a particular emphasis on lower income taxation and special tax holiday for offshore corporate cash repatriation.

In addition to its recent acquisition of Whole Foods, Amazon can draw down its offshore cash reservoir throughout the prospective tax holiday to continue the current Trump stock market rally. The same logic also applies to several other multinational corporations such as Apple, Google, Microsoft, Facebook, Exxon Mobil, Johnson & Johnson, and so forth. Although the stock market valuation seems high with a long-term P/E ratio of 25x to 27x, the Trump stock market rally may move in tandem with the current interest rate hike as new economic data suggest robust labor market recovery and capital momentum.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-02-11 07:30:00 Sunday ET

President Trump unveils his ambitious $1.5 trillion public infrastructure plan. Trump proposes offering $100 billion in federal incentives to encourage stat

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2020-07-26 15:29:00 Sunday ET

Firms and customers create value and wealth together by joining the continual flow of small batches of lean production to the lean consumption of cost-effec

2023-05-14 12:31:00 Sunday ET

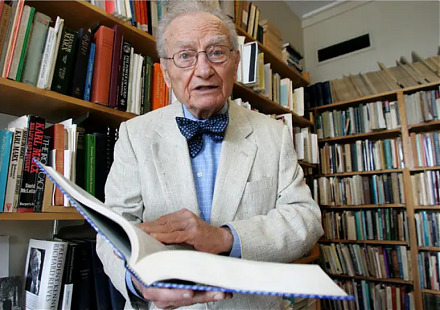

Paul Samuelson defines the mathematical evolution of economic price theory and thereby influences many economists in business cycle theory and macro asset m

2019-01-06 08:39:00 Sunday ET

President Trump signs an executive order to freeze federal employee pay in early-2019. Federal employees face furlough or work without pay due to the govern

2020-11-17 08:27:00 Tuesday ET

Management consultants can build sustainable trust-driven client relations through the accelerant curve of business value creation. Alan Weiss (2016)