2017-08-19 14:43:00 Sat ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

In a recent tweet, President Donald Trump criticizes Amazon over taxes and jobs. Without providing specific evidence, Trump accuses of the e-commerce retailer of hurting U.S. cities and states with job losses. Amazon's stock price declines quite a bit after this tweet. In his critique, Trump has targeted Amazon whose CEO Jeff Bezos owns the Washington Post, one of several major media outlets that have been swept up in the president's relentless fight with the press.

Now stock analysts and market observers wait for Treasury Secretary Steve Mnuchin to deliver on Trump's promise of a comprehensive fiscal overhaul with a particular emphasis on lower income taxation and special tax holiday for offshore corporate cash repatriation.

In addition to its recent acquisition of Whole Foods, Amazon can draw down its offshore cash reservoir throughout the prospective tax holiday to continue the current Trump stock market rally. The same logic also applies to several other multinational corporations such as Apple, Google, Microsoft, Facebook, Exxon Mobil, Johnson & Johnson, and so forth. Although the stock market valuation seems high with a long-term P/E ratio of 25x to 27x, the Trump stock market rally may move in tandem with the current interest rate hike as new economic data suggest robust labor market recovery and capital momentum.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-01-23 09:30:00 Monday ET

There are several highlights from the first news conference after Trump's presidential election victory: The Trump administration will repeal-and-

2018-09-30 14:34:00 Sunday ET

Goldman, JPMorgan, Bank of America, Credit Suisse, Morgan Stanley, and UBS face an antitrust lawsuit. In this lawsuit, a U.S. judge alleges the illegal cons

2018-06-03 07:35:00 Sunday ET

Several recent events explain why Trump may undermine multilateral world order. First, Trump withdraws the U.S. from the 12-nation Trans-Pacific Partnership

2019-01-02 06:28:00 Wednesday ET

New York Fed CEO John Williams listens to sharp share price declines as part of the data-dependent interest rate policy. The Federal Reserve can respond to

2018-01-21 07:25:00 Sunday ET

As he refrains from using the memorable phrase *irrational exuberance* to assess bullish investor sentiments, former Fed chairman Alan Greenspan discerns as

2018-12-21 11:39:00 Friday ET

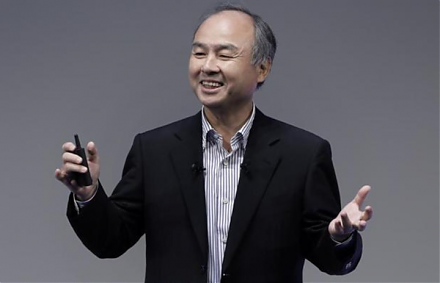

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f