2023-10-21 11:32:00 Sat ET

stock market federal reserve monetary policy treasury fiscal policy deficit debt technology covid-19 employment inflation global macro outlook interest rate fiscal stimulus economic growth central bank fomc capital global financial cycle gdp output

Walter Scheidel (2019)

Escape from Rome: the failure of empire and the road to prosperity

Walter Scheidel argues that persistent European fragmentation after the collapse of the Roman Empire is responsible for modern economic growth and development. The origins of maximum sustainable economic growth continue to fascinate many scholars across the social sciences and humanities. What helps explain the Great Divergence between the western world and most other parts of Eurasia (especially China) after 1750 CE? The book Escape from Rome delves into a recent strand of research (from Montesquieu and Hume to Acemoglu and Robinson) to connect the recent economic divergence to the institutional divergence between a polycentric Europe and an imperial China. Scheidel reframes the main theme that competitive European state fragmentation can serve as a necessary condition for the eventual economic rise of Western Europe.

Scheidel explains this economic divergence in terms of the long historical evolution, not only of Europe, but also of Asia (especially China). He strives to explain why a large-scale empire arose only once in European history, but inevitably turned out to be a recurrent equilibrium feature of state formation elsewhere in Eurasia. In this view, Scheidel offers an excellent institutional history of European state formation from Rome onwards. Escape from Rome begins with the observation that for the last 1,500 years, Europe and China have adopted polar extreme state systems. In most Europe, political fragmentation prevailed in state formation, whereas, unitary empire tended to persist in China. Prior to this point, the pervasive patterns of state formation at either end of Eurasia looked remarkably similar.

Both the Romans and Han dynasty ruled big empires with armies and professional bureaucracies, financed state affairs through taxation, and resembled each other in the first few centuries CE. A watershed moment was the decisive failure for most European states to reconstitute a new empire after the fall of the Western Empire. This failure caused an early medieval divergence in political economic institutions between Western Europe and other parts of Eurasia. Meanwhile, the long decline and fall of the later Han dynasty gave way to a long period of chaos and intermittent war in China. This relatively long period of 5 dynasties and 10 kingdoms eventually ended and led to the imperial Song dynasty in China. With respect to the economic divergence between Western Europe and China after the fall of the Roman Empire, Scheidel considers several canonical causes of European fragmentation: culture, geography, and inclusive institutions. These root causes interact with one another to drive better economic growth, development, and technological innovation etc in Western Europe over the subsequent centuries.

As Scheidel argues, large empire formation can arise from both the strong imperial core and the weaker periphery. The secret to Roman success was manpower. This manpower rested on the broader alliance system and the Roman ability to recruit new citizens. Rome was able to mobilize bigger and stronger armies than its main rivals. There were at least 3 unique aspects to Roman manpower. First, Rome was generous in offering citizenship to freemen and immigrants. As a result, the citizen population of Rome itself rose rapidly during the Republican period. Second, the Roman alliance system within Italy was a stable and important source of additional manpower. Italian elites found the alliance sufficiently beneficial such that the main rivals such as Hannibal found it difficult to induce them to defect. Third, the fraction of male Roman citizens who served in the army was remarkably high. The Roman state conscripted male labor in lieu of stringent taxation.

Republican Rome was remarkable in maintaining very high levels of mobilization for several centuries. Roman war mobilization was critical to holding together the political equilibrium at home. In Rome, the Republican system was like a criminal gang that compensated its victims by enrolling them in further criminal activities. Rome was at war about 90% of the time in the Republican period (291/310 years between 410-101 BCE) (Scheidel, 2019, pp.80).

Roman military success was made possible by the fragility of nearby states. Early Roman state formation could proceed without major external interference because this state formation began in an Italian peninsula that was at the periphery of the ancient world. During that time, the major geopolitical competitors from Carthage and Macedon to the Seleucid and Ptolemaic Empires could not match the Roman levels of war mobilization.

At a deeper level, climatic conditions favored the expansion of the Mediterranean economic zone. Roman expansion occurred when the Mediterranean experienced an especially favorable climate. Warm, wet, and more predictable weather meant that the agricultural productivity of southern Europe and North Africa was higher. The economic rise of Rome was then far from being an accident of history and so was a natural result of climatic, geographic, and institutional factors (Harper, 2017).

Why did none of Roman successor states come close to achieving a comparable level of state hegemony in Europe? Scheidel applies a counterfactual approach to addressing this broader question. Perhaps the best opportunity for Rome to build a second Europe-wide empire was the first ambitious reconquest of Italy and North Africa by Justinian I in the mid-sixth century. The eastern empire did not choose to dispose of the military manpower. This military manpower had allowed Republican Rome to hold large parts of Western Europe. Subsequent attempts to build another empire turned out to be even more implausible in Europe. These attempts included the counterfactual Islamic European empire, a long-lasting hegemonic Frankish empire, and another medieval German empire under either the Hohenstaufens or the Ottonians.

In China, the Han empire weakened and collapsed in the third and fourth centuries. Unlike the Roman Empire, China reunified the 5 dynasties and 10 kingdoms in the Song empire. After the collapse of the Roman Empire, the initial failure for Western Europe to reinstitute another empire set in motion both European state formation and fragmentation. This fragmentation led European states to build on a different trajectory of economic development. Scheidel refers to this development the first great divergence in Eurasian state formation between 500 and 1000 CE.

The first aspect of the first great divergence in Eurasian state formation concerns fiscal taxation. In China, a land taxation system reconstituted each dynastic cycle. In Europe, however, the Roman fiscal system gradually weakened in post-Roman Western Europe (Wickham, 2005). In the absence of stable land taxation, the scale of both political authority and military mobilization shrank. The initial legacy of the escape from Rome thus contributed to subsequent state formation in Europe.

The second aspect of the first great divergence in Eurasian state formation relates to the nature of political institutions. European rulers had to bargain with their own respective noble elites. Over time, this political process allowed these noble elites to institutionalize their power in order to help reduce the number of revolts, coups, and assassinations. Using the duration of rulers as a measure of political stability, Blaydes and Chaney (2013) suggest that Europe began to diverge from the middle east from the ninth century onwards. The key medieval practice of European rulers negotiating with their noble elites would be the future foundation for investments in state capacity. Also, Chinese emperors were able to attain greater political power at the same time that European monarchs did so. In Europe, this political stability arose from the rise of representative institutions, whereas, greater longevity turned out to be the result of a more reliable system of hereditary succession in China.

The third aspect of the first great divergence in Eurasian state formation concerns the emergence of both ideational and cultural developments. The great divergence set in motion both ideational and cultural developments that would exacerbate the European deviation from wider Eurasian trends. From time to time, religion played an important role in new state formation in both Europe and the middle east (Rubin, 2017; Johnson and Koyama, 2019). The Catholic Church played a major decisive role in maintaining the European polycentric political institutions by playing secular rulers against one another. Moreover, these institutions further helped break down tribal kinship networks. These ideational and cultural developments led to the rise of representative institutions in Western Europe. These representative institutions contributed to future economic growth, development, and technological progress in Europe. Specifically, the Catholic Church controlled elite constituents, coerced rivals, and kept economic resources in Europe. This religious control was likely to interfere with state formation (Scheidel, 2019, pp. 316).

In his book Guns, Germs, and Steel, Jared Diamond (1997) explains why Eurasian and North African civilizations seem to have survived in due course. At the same time, Diamond argues against the idea that Eurasian hegemony results from any specific form of Eurasian moral, intellectual, or inherent genetic superiority. From a practical viewpoint, Diamond argues that the substantial gaps in both power and technology between human societies tend to arise from environmental differences. Positive feedback loops can often help amplify these environmental differences. While several cultural or genetic differences seem to have favored Eurasians (e.g. both written language and the important development of health care resistance to endemic diseases among Eurasians), Diamond suggests that these major internal advantages often result from the broader influence of geography on cultures and societies. For instance, geography allows both world trade and commerce between different cultures. These central economic interactions cannot be found in Eurasian genomes. In essence, Diamond advocates that structural changes in the external environment can often help shape human interactions worldwide through cultures and beliefs across major civilizations in global economic history.

Scheidel connects the unique European path of state formation to the interactions between geography and institutional development. Mountain barriers, forests, and coastlines impeded the post-Roman development of empires in Europe. In contrast to Diamond and other scholars who have emphasized the link between European geography and persistent political fragmentation, Scheidel draws attention to the dialectical process of post-Roman state (re)formation that arose from the physical environment in Europe (Scheidel, 2019, pp. 263-264).

Daron Acemoglu, Simon Johnson, and James Robinson (2001 and 2002) present empirical analysis of the robust nexus between colonialism and subsequent poor social infrastructure (and thus subpar economic growth). In their institutional view, geographic differences between (sub)tropical and temperate areas at the time of colonization have caused Europeans to colonize with both extractive and inclusive institutions. The different strategies of colonization affect subsequent institutional development. For this reason, the chosen establishment of inclusive or extractive institutions serves as a crucial source of global differences in social infrastructure and economic growth nowadays.

Acemoglu, Johnson, and Robinson (2001) empirically emphasize the geographic disease environment. Europeans face extremely high mortality risks in key tropical areas (particularly from malaria and yellow fever), but the average death rates are substantially lower in temperate regions. In the tropical high-disease environments, European colonizers establish extractive states or authoritarian institutions in order to exploit natural resources from these colonies with little settlement and property protection. In the temperate low-disease environments, European colonizers tend to establish inclusive states or settler colonies with democratic rule of law.

Acemoglu, Johnson, and Robinson (2002) focus on the previous level of economic development on the eve of colonization. In key colonies with dense population and greater institutional development, it proves to be more attractive for Europeans to establish extractive states than inclusive states and settler colonies. This particular colonization strategy leads to the great reversal of fortune that the settler colonies with inclusive institutions tend to experience better economic growth and middle-class income stability (in stark contrast to extractive states). This key empirical fact prevails in the economic comparison of North America versus South America.

Since the seminal work of Nobel Laureate Douglass North, many economists have distinguished between the proximate causes of economic growth (such as capital investment and human capital accumulation etc) and deeper explanations (North and Thomas, 1973). In recent decades, Acemoglu, Robinson, and their co-authors empirically show that inclusive institutions have been the most important deep root causes of the origins of economic growth. For Scheidel, the robust European poly-centrism set in motion a major post-Roman system of both institutional dynamism and inter-state competition. The first great divergence paved the foundation for the institutional transformation that would eventually make possible modern economic growth (and hence the second great divergence in Eurasian state formation).

In Europe, inter-state competition served as a central driver of military innovation. Smaller European states were able to survive into the early modern period despite frequent warfare because they were more capital intensive (Abramson, 2017). In this light, Scheidel connects the capital intensity of military state competition in late medieval and early modern Europe to the first great institutional divergence in 500 to 1000 CE. In post-Roman Europe, nominal political power became diffuse from military power and economic clout etc. Empire formation would have necessitated creating from scratch a fresh fiscal system, destroying local noble elites, crushing independent cities, and subordinating religious churches in Western Europe. From a practical perspective, European cultural unity meant that the scholars across the entire continent were able to communicate with one another. The resultant Europe-wide culture of modern economic growth transcended political, intellectual, military, and religious boundaries.

Many economists, historians, and social scientists etc celebrated the long-distance voyages that the Ming dynasty launched in the early fifteenth century as examples of Chinese naval prowess. The same scholars used these examples to argue that European expansion into the Atlantic was fortuitous. Scheidel takes the opposite position. He views the Ming dynasty long-distance voyages as a textbook case of monopolistic decisions: the Ming dynasty launched these voyages in search of the prior lost emperor who eventually gave up his throne for better societal harmony. The Ming dynasty launched the long-distance voyages at enormous expenses for no tangible material benefits. These voyages were equally swiftly shut down once political preferences changed at the imperial court (Scheidel, 2019, pp. 402). From a practical viewpoint, Scheidel focuses on the contrast between the Chinese Ming and European long-distance voyages that were undertaken for reasons of dynastic prestige. The later European voyages thus illuminated the extractive and inclusive institutions and colonization strategies all over the world. The specifically inclusive institutions turned out to shape economic growth, development, and technological progress in the second great divergence in terms of both European exceptionalism and state formation.

We can compare Escape from Rome to the recent book, The Narrow Corridor, by Daron Acemoglu and James Robinson (2019). Acemoglu and Robinson argue that what made modern economic inclusive institutions possible was a dialectical race between society and the state. The state has the legal and political power to govern civic affairs, and civil society holds the state accountable with economic inclusive institutions. Both Escape from Rome and The Narrow Corridor shift the origins of European institutional development back to the first millennium CE. Acemoglu and Robinson view Europe as entering the corridor because early medieval European societies benefited from the egalitarian legacy of the German tribes who used core bottom-up institutions to constrain state power (and from the legacy of Roman law and universalism). In contrast to Scheidel, Acemoglu and Robinson downplay the role of the state system as a meta-level inclusive institution. In fact, Acemoglu and Robinson focus on the positive effect of inclusive institutions on economic growth and development within each society.

Authors of the book Why Nations Fail, Daron Acemoglu and James Robinson show a constant economic tussle between the state and the society in the fate of liberty. The state maintains socioeconomic order but may inadvertently grow oppressive. The society pursues liberty but cannot sustain order. The constant conflict between society and the state spans much of human history. Acemoglu and Robinson offer practical examples over human history from Gilgamesh to Donald Trump, and over geography from the city state of Athens to Hawaii and the Zulu nation. Specifically, Acemoglu and Robinson address one of the biggest questions for humankind: how can liberty become sustainable against the dangers of disorder, on one hand, and oppression on the other hand? Their definition of liberty follows John Locke: liberty reflects perfect freedom of most ordinary people to order their social and economic actions as these people think fit. This basic human right of liberty is a fundamental long-term aspiration. No one should harm another person in his or her life, health, liberty, and possessions. Innovation requires creativity. In turn, creativity calls for liberty.

The fate of liberty often hinges on a delicate balance in a relentless tussle between society and the state. Society wants liberty but finds it difficult to solve the collective action problem of maintaining order in law enforcement, social violence control and prevention, and the state provision of public services such as infrastructure, health care, and education etc. For better social order, society needs to build a stronger state. Society further controls and shackles the stronger state to avoid the fear and repression by despotic leaders. The latter is another collective action problem.

A stateless society (or Absent Leviathan) can degenerate into total disorder. When social norms and beliefs serve as a cage, these norms and beliefs often constrain actions and behaviors, favor some in society over others, and inhibit creativity and innovation for technological progress. The state takes over the task of maintaining order to relax the cage of social norms and beliefs. However, the state sometimes becomes oppressive (or Despotic Leviathan), serves its own interests, levies hefty and arbitrary taxes, and restricts freedom of thought and expression in many ways. These state pursuits are bad for economic growth, development, and technological progress. Between the 2 extreme cases is the narrow corridor where governance allows the state to harness enough power to maintain order, but not so much as to be oppressive. A better balance between state control and social peace preserves liberty and then facilitates economic growth and development.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

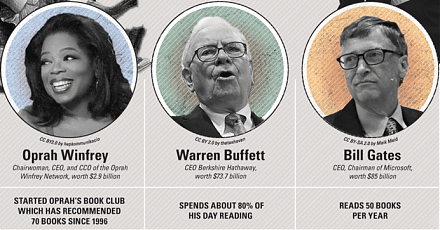

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-21 09:25:00 Saturday ET

President Trump praises great unity and progress at the G7 summit with respect to Sino-U.S. trade conflict resolution, global climate change, containment fo

2019-10-31 13:38:00 Thursday ET

AYA Analytica finbuzz podcast channel on YouTube October 2019 In this podcast, we discuss several topical issues as of October 2019: (1)

2019-08-07 12:33:00 Wednesday ET

Conor McGregor learns a major money lesson from LeBron James. This lesson suggests that James spends about $1.5 million on his own body each year. The $1.5

2025-06-13 08:23:00 Friday ET

What are the mainstream legal origins of President Trump’s new tariff policies? We delve into the mainstream legal origins of President Trump&rsquo

2018-01-04 07:36:00 Thursday ET

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2017-07-07 10:33:00 Friday ET

Warren Buffett invests in American stocks across numerous industries such as energy, air transport, finance, technology, retail provision, and so forth.