2019-04-01 08:28:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

OraSure and its subsidiary DNA Genotek specialize in the lean production of home DNA spit tubes. OraSure extracts core genetic information from microbiome saliva samples and then provides discreet DNA diagnostic test tubes and kits for liquid biopsy, hepatitis, cancer, and HIV etc. In the meantime, OraSure and its subsidiary DNA Genotek serve as a quasi-monopoly with secure economic rent protection in the new biotech market for DNA spit tubes.

As there has been a substantial increase in international demand for cost-effective and affordable DNA tests over the past decade, OraSure gains much from its R&D-driven royalty revenue. As of April 2019, the small-cap stock OraSure trades at a P/E ratio of 16.6x near most long-term average stock market benchmarks. Further, the current stock market capitalization of OraSure is almost 3.4x times total sales and 2.2x times total book assets. From a fundamental perspective, OraSure enjoys juicy profit margins: the gross profit margin of 62.5% exceeds most stock market benchmarks, and the net profit margin hovers in the healthy range of 11%-15% in recent times. As its broad biotech patents and trademarks represent fundamental competitive moats and niches, OraSure continues to dominate in the new specialty market for DNA diagnostic test tubes.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-08-28 14:46:00 Wednesday ET

Santa-Barbara political economy professor Benjamin Cohen proposes new fiscal stimulus to complement the current low-interest-rate monetary policy. Cohen fin

2023-05-31 03:15:40 Wednesday ET

The U.S. further derisks and decouples from China. Why does the U.S. seek to further economically decouple from China? In recent times, th

2023-11-07 11:31:00 Tuesday ET

Joel Mokyr suggests that economic growth arises from a change in cultural beliefs toward technological progress. Joel Mokyr (2018) A culture

2019-01-31 08:40:00 Thursday ET

We offer a free ebook on the latest stock market news, economic trends, and investment memes as of January 2019: https://www.dropbox.com/s/4d8z

2017-11-29 07:42:00 Wednesday ET

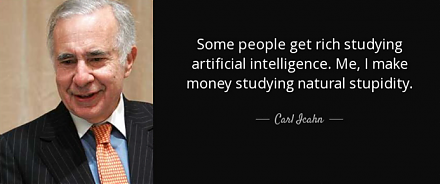

The octogenarian billionaire and activist investor Carl Icahn mulls over steps to shake up the board of SandRidge Energy after the oil-and-gas company adopt

2020-08-01 07:28:00 Saturday ET

Technological advances, geopolitical risks, and pandemic outbreaks cannot shake investor confidence in the American dollar as the global reserve currency.