2019-04-01 08:28:00 Mon ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

OraSure and its subsidiary DNA Genotek specialize in the lean production of home DNA spit tubes. OraSure extracts core genetic information from microbiome saliva samples and then provides discreet DNA diagnostic test tubes and kits for liquid biopsy, hepatitis, cancer, and HIV etc. In the meantime, OraSure and its subsidiary DNA Genotek serve as a quasi-monopoly with secure economic rent protection in the new biotech market for DNA spit tubes.

As there has been a substantial increase in international demand for cost-effective and affordable DNA tests over the past decade, OraSure gains much from its R&D-driven royalty revenue. As of April 2019, the small-cap stock OraSure trades at a P/E ratio of 16.6x near most long-term average stock market benchmarks. Further, the current stock market capitalization of OraSure is almost 3.4x times total sales and 2.2x times total book assets. From a fundamental perspective, OraSure enjoys juicy profit margins: the gross profit margin of 62.5% exceeds most stock market benchmarks, and the net profit margin hovers in the healthy range of 11%-15% in recent times. As its broad biotech patents and trademarks represent fundamental competitive moats and niches, OraSure continues to dominate in the new specialty market for DNA diagnostic test tubes.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-04-11 09:37:00 Wednesday ET

North Korean leader and president Kim Jong-Un seeks peaceful resolution and denuclearization on the Korean Peninsula. When *peace* comes to shove, Asia

2023-02-07 08:26:00 Tuesday ET

Michel De Vroey delves into the global history of macroeconomic theories from real business cycles to persistent monetary effects. Michel De Vroey (2016)

2019-01-07 18:42:00 Monday ET

Neoliberal public choice continues to spin national taxation and several other forms of government intervention. The key post-crisis consensus focuses on go

2018-01-23 06:38:00 Tuesday ET

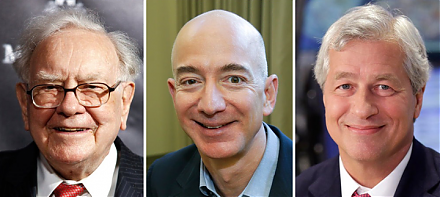

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial