2019-05-02 13:30:00 Thu ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Netflix has an unsustainable business model in the meantime. Netflix maintains a small premium membership fee of $9-$14 per month for its unique collection of TV shows, programs, and movies etc, whereas, HBO charges $15 per month. With its original video content, Netflix earns a mere net profit of 28 cents per subscriber (in comparison to $3.65 for HBO) due to high programming costs and low subscription prices. As Netflix expands into international video markets, these margins cannot be feasible in the long run.

Netflix relies on vertical integration to curate more original video content with lower programming costs. As the average Netflix subscriber streams video for about 2 hours per day, this integration empowers Netflix to charge higher premiums. Netflix can run ads on the broad network of almost 150 million subscribers worldwide (60 million U.S. subscribers) as of early-2019. Ad executive heads from YouTube and JPMC to external media agencies such as UM and MediaLink view running ads as an inevitable fresh fallback route for Netflix. With $15 billion annual costs and $10 billion debt mountains, Netflix needs to find feasible ways to monetize its user base. As NYU business valuation professor Aswath Damodaran suggests, Netflix now has an unsustainable business model.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

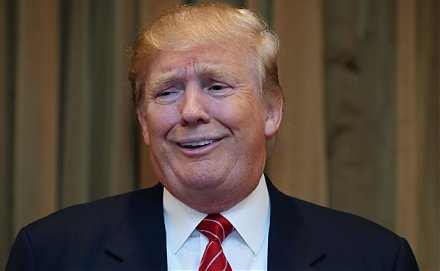

2017-09-03 10:44:00 Sunday ET

President Donald Trump has released his plan to slash income taxes for U.S. citizens and corporations. The corporate income tax rate will decline from 35% t

2019-11-07 14:36:00 Thursday ET

America expects to impose punitive tariffs on $7.5 billion European exports due to the recent WTO rule violation of illegal plane subsidies. World Trade Org

2018-06-09 16:40:00 Saturday ET

The Trump administration introduces new tariffs on $50 billion Chinese goods amid the persistent bilateral trade dispute. The tariffs effectively boost cost

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2018-06-01 07:30:00 Friday ET

The U.S. federal government debt has risen from less than 40% of total GDP about a decade ago to 78% as of May 2018. The Congressional Budget Office predict

2023-11-30 08:29:00 Thursday ET

In addition to the OECD bank-credit-card model and Chinese online payment platforms, the open-payments gateways of UPI in India and Pix in Brazil have adapt