2020-06-10 10:35:00 Wed ET

technology team work streams proprietary assets culture changes perseverance resilience passion growth core business operations disruptive innovation megatrends dual transformation purpose vision mission mergers acquisitions blue ocean sustainable profitability meritocracies niche

Most lean enterprises should facilitate the dual transformation of both core assets with fresh cash flows and new growth options.

Scott Anthony, Clark Gilbert, and Mark Johnson (2017)

Dual transformation: how to reposition the modern business in the new future

Many business leaders now face the greatest challenge of market niche disruption. This market niche disruption often displaces the current market by providing fresh solutions to a broader market in a new and different business model. Key corporate decision-makers need to proactively expect their business models to evolve over time. These business decision-makers should be ever vigilant of both lean startups and fringe markets. To survive disruptive market niche changes, business leaders must take the necessary steps to reposition their core assets in place with business operations and steady cash streams (i.e. the first transformation); at the same time, these business leaders must drive new business growth in blue-ocean markets (i.e. the second transformation). This dual transformation shares a core capabilities link of proprietary assets that facilitate key business operations with competitive moats, first-mover advantages, positive network effects, and scale economies etc.

In light of potential market niche disruption, the first transformation generates the steady cash flows to fund the second transformation. The latter usually contributes little to the bottom-line at the initial stage. Over time, the core business operations may decline due to structural shifts in market niche demand. At this later stage, the second transformation boosts new growth in the customer-centric proof of concept. This subsequent success can generate an increasingly larger fraction of corporate profits. Should tech titans, unicorns, or lean enterprises attempt to break out of the predictable patterns of sustainable success and innovation thus far, it is essential for these modern data-driven enterprises to promote an internal culture of curiosity, creativity, experimentation, as well as the freedom to fail forward. Business leaders carefully choose and pursue fresh market niche opportunities only after thorough quantitative and qualitative future-back analysis.

Business leaders must manage generic expectations and specific relations among stakeholders such as senior executive directors and middle managers, employees, suppliers, customers, shareholders, and even regulators. All of these stakeholders must secure long-run sustainable business success, performance, and profitability behind a common core purpose. It is critical for business leaders to keep separate internal teams for the respective first and second transformations. In the meantime, senior managers maintain an executive bias toward the second transformation of disruptive market niche growth options; yet, the first transformation of key business operations still attracts most corporate resources such as capital funds and people. Business leaders and executive managers must convince skeptical board directors and major shareholders to stay the course since it often takes many years or even a decade for disruptive market niche efforts to gain traction in due course.

This dual transformation requires focus, courage, and determination for corporate decision-makers and other business leaders to turn legacy businesses on the brink of competitive irrelevance today into new market niche bellwethers tomorrow. For this reason, senior executive managers need to learn how they can reposition the modern business in comparison to key stakeholders to better prepare for the future. When competitive threats become fresh business opportunities, business leaders can reinvent the next economic engine of both active user growth and monetization in response to many disruptive market forces and shock waves. When push comes to shove, the law inadvertent consequences counsels caution.

It is important for most business leaders to connect this dual transformation to the q-theoretic prediction of a negative empirical nexus between corporate investment and average return performance. Recent literature focuses on the q-theory that in turn links firm-specific sequential investment decisions to market risk premiums or subsequent average returns. When most firms invest in M&A and capital stock, the investment transforms risky real growth options into less risky assets that generate steady streams of future cash flows. This dual transformation continues until these firms exhaust available positive net-present-value investment projects. As a result, these firms reduce their exposure to systematic risk during this dual transformation as most rational investors require lower average asset returns. In this positive light, the q-theory predicts a negative empirical relation between corporate investment and subsequent average asset return performance. Some recent empirical studies confirm this negative nexus and dual transformation.

This dual transformation calls for both repositioning the major business operations and attracting new customers in emergent blue-ocean markets.

This dual transformation describes 2 key parallel changes in response to disruptive shock waves: the first transformation emphasizes repositioning the major business operations, whereas, the second transformation attempts to unlock new growth in emergent blue-ocean markets. Both the first and second transformations share the core-capabilities link of proprietary assets with steady cash streams that empower incumbents to attain competitive moats and first-mover advantages. These moats and advantages can allow incumbents to better compete against lean enterprises. These core assets in place often include proprietary tech advances, stores, brands, trademarks, patents, copyrights, apps, platforms, client networks, and so forth.

The first transformation focuses on new solutions to an old problem. In comparison, the second transformation seeks fresh solutions to similar problems in a new way. Adjacencies use the extant core capabilities to find technological solutions to fresh similar problems, especially when a larger company acquires some other smaller lean startups and their core capabilities. Through the dual transformation, business decision-makers often think outside the box, challenge the status quo, and design new products and services to meet new consumer demands in blue-ocean markets.

By finding more effective ways to address new consumer demands, several public corporations such as Adobe, Amazon, Google, and Netflix etc can further increase their resilience and relevance in the face of disruptive market niche shock waves. In order to boost the first transformation, the business organization must first define in detail what unique post-disruption jobs can be done for most current customers. At this stage, disruptive innovators design and develop the best business model to better deliver value against these jobs-to-be-done. Through feature enhancements and iterative continuous improvements, the business organization sets and tracks new metrics, learns from past mistakes, improves the core legacy operations, and then derives new actionable business insights. The resultant positive changes can help further strengthen the first transformation of major legacy business operations.

The second transformation requires creating new-growth business operations that help capitalize on disruptive market trends. For instance, Amazon started with the online legacy bookstore website and then expanded into an e-commerce platform with cloud software service provision. Also, Google first focused on Internet search engine optimization and then expanded into the Alphabet parent company across numerous online software suites and applications for digital information technology diffusion and proliferation. Apple and Microsoft began the major legacy operations in holistic computer development (with both software and hardware components), and then these tech titans jumped on the market bandwagon of mobile connectivity to capitalize on smart mobile devices such as the revolutionary iPhone, iPod, iPad, iWatch, MacBook, Surface Pro, and so on. In essence, the second transformation helps render multi-market competition irrelevant in new blue-ocean markets.

To pursue the second transformation, senior business leaders need to identify the prevalent market constraints. These market constraints often manifest in the form of many problems that most customers cannot solve in the meantime due to a lack of resources such as specific skills, capital funds, and leisure hours. From time to time senior business leaders must break down the consumption barriers that keep cost-effective solutions out of reach. For the second transformation, core disruptive innovators should carry out iterative continuous feature enhancements to develop new business models to better serve the new market niche segments. Size begets size. The current loyal customers can attract more consumers who are keen to try out new products, services, and solutions. In this positive light, corporate decision-makers and other senior business leaders need to establish strategic partnerships, alliances, joint ventures, mergers, and new talent acquisitions to secure the current competitive advantages. These business leaders should remain open to fresh tests and experiments for better product design and service provision in new blue-ocean markets. For the second transformation to succeed in the future, business leaders must be keen to learn from past mistakes, setbacks, failures, and disappointments. These negative events may be essential for the next major disruptive innovations to emerge in the broader context of new market trends. Therefore, senior business leaders should retain long-term focus and global reach through iterative continuous improvements and many other disruptive feature enhancements etc.

The core-capabilities link connects both components of the dual transformation via better corporate resource allocation and smoother intertemporal substitution.

Tech titans and other large corporations can better compete against lean startups because the former often build scalable core assets. These core proprietary assets are difficult for most other competitors to replicate in the short run. If tech titans or other large corporations can manage to combine these key proprietary assets with the right amount of entrepreneurism, these industry bellwethers can turn the dual dilemma of both sustainable and disruptive innovations into emergent market niche opportunities. This dual transformation entails the core-capabilities nexus between the core proprietary assets with steady cash flows and new growth options. In brief, this dual transformation focuses on expanding into fresh blue-ocean markets that most other competitors cannot serve in the meantime.

The core-capabilities link tilts an executive bias toward the second transformation of growth options. Senior business leaders and corporate decision-makers should carefully choose the core capabilities that direct capital funds, skills, and people to the second transformation of exponential growth investment projects in blue-ocean markets. At the same time, these strategic choices cannot compromise the smooth core business operations with steady sales and profits for the first transformation.

Senior business leaders should keep both components of this dual transformation independent and distinct. The current legacy business operations need to generate sufficient cash flows, capital funds, and human resources to help support the next disruptive firm expansion into the uncharted territory of fresh blue-ocean markets. Over the normal course of several years or even a decade, senior business leaders exercise new growth options, transform them into core proprietary assets with new cash streams, and then replace prior legacy business operations with exponential growth investment projects. How robust the core-capabilities link remains over time often determines the eventual success of this dual transformation.

Business leaders must conduct future-back analysis to assess both the qualitative and quantitative parts of market niche disruption with curiosity and perseverance.

A future-back mindset helps most business leaders envision what their companies can become after some market niche disruption. Traditional firm-specific strategies tend to be present-forward: these strategies rely heavily on past data and so tend to project the current business several years forward as a result. In most times of market niche disruption, this traditional approach underplays the major threats and opportunities in new blue-ocean markets.

In stark contrast, future-back analysis comprises both quantitative and qualitative components. Through a specific series of queries and dialogues, business leaders share a consensus view of what the future may look like amid substantial economic policy uncertainty. These business leaders envision and become the main change that key people would like to experience in the world in due course. This alternative future-back approach opens up strategic options with better clarity, focus, curiosity, and perseverance over time.

Through this dual transformation, business leaders go through predictable crises of commitment, conflict, and social identity. The first-transformation team needs to continue to play an important role in the foreseeable future. At the same time, the second-transformation team needs unshakable senior management support and resource allocation (even in light of skepticisms, criticisms, and sub-optimal short-term results). Although this dual transformation tends to tilt an inherent bias toward the second-transformation team, it is important for senior business leaders to value the long-term contributions of the first-transformation team on the primary basis of both near-term sales and profits.

Senior business leaders must maintain long-term fundamental perspectives as the business organization attains several major milestones of this dual transformation. The first-and-second transformation teams must remain distinct and independent with a common purpose, a mission statement, and the robust core-capabilities link. When push comes to shove amid substantial economic policy uncertainty, the law of inadvertent consequences counsels caution.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) © 2013-2023

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-28 12:39:00 Thursday ET

New York Fed CEO John Williams sees no need to raise the interest rate unless economic growth or inflation rises to a high gear. After raising the interest

2019-07-31 11:34:00 Wednesday ET

AYA Analytica finbuzz podcast channel on YouTube July 2019 In this podcast, we discuss several topical issues as of July 2019: (1) All 18 systemical

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2018-11-07 08:30:00 Wednesday ET

PwC releases a new study of top innovators worldwide as of November 2018. This study assesses the top 1,000 global companies that spend the most on R&D

2017-06-27 05:40:00 Tuesday ET

These famous quotes of self-made billionaires are inspirational words of wisdom on financial management, innovation, and entrepreneurship. For financial

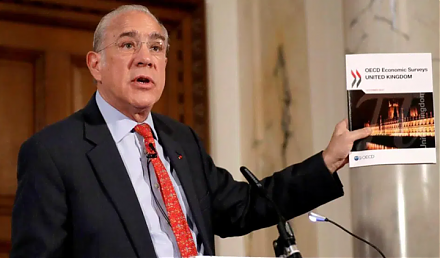

2019-10-29 13:36:00 Tuesday ET

The OECD projects global growth to decline from 3.2% to 2.9% in the current fiscal year 2019-2020. This global economic growth projection represents the slo