2019-11-23 08:33:00 Sat ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement that focuses on better stakeholder value maximization for employees, customers, and suppliers. Johnson proposes 3 primary issues when we reconsider capitalism in response to the neoliberal consensus. First, market incentives are often positive in some contexts. It is not enough for entrepreneurs to raise capital to promote good social causes. Entrepreneurs often need to come up with a sustainable business model that promises steady future profits. Only profitable ventures survive the test of time, so founders and most senior executive managers often tend to fixate on near-term profitability.

Second, powerful policymakers and interest groups can distort sensible economic analysis to bolster the consensus view of business sustainability. It would be better for all parties to strike a delicate balance between public efforts and private motives. However, ulterior motives cannot align well with good causes.

Third, the private sector typically cannot take into account negative externalities. In this light, the public sector may need to play an important role in advancing basic science for better health care, infrastructure, technology, and so on. On balance, this consideration helps enhance macro policy outcomes in light of climate change and economic inequality.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2017-04-07 15:34:00 Friday ET

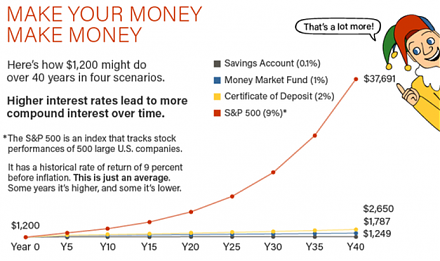

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month? At first glance, this counterintuitive

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2018-05-04 06:29:00 Friday ET

Commerce Secretary Wilbur Ross suggests that 5G remains a U.S. top technology priority in light of the telecom merger proposal between Sprint and T-Mobile a

2024-02-04 08:28:00 Sunday ET

Our proprietary alpha investment model outperforms most stock market indexes from 2017 to 2024. Our proprietary alpha investment model outperforms the ma

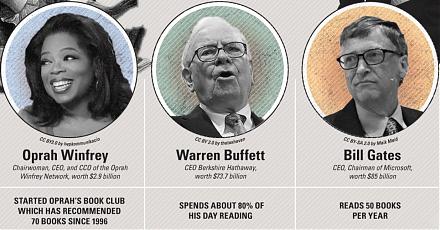

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte