2019-11-23 08:33:00 Sat ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

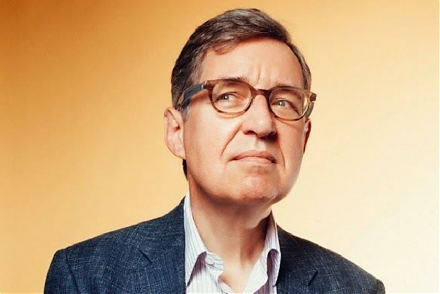

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement that focuses on better stakeholder value maximization for employees, customers, and suppliers. Johnson proposes 3 primary issues when we reconsider capitalism in response to the neoliberal consensus. First, market incentives are often positive in some contexts. It is not enough for entrepreneurs to raise capital to promote good social causes. Entrepreneurs often need to come up with a sustainable business model that promises steady future profits. Only profitable ventures survive the test of time, so founders and most senior executive managers often tend to fixate on near-term profitability.

Second, powerful policymakers and interest groups can distort sensible economic analysis to bolster the consensus view of business sustainability. It would be better for all parties to strike a delicate balance between public efforts and private motives. However, ulterior motives cannot align well with good causes.

Third, the private sector typically cannot take into account negative externalities. In this light, the public sector may need to play an important role in advancing basic science for better health care, infrastructure, technology, and so on. On balance, this consideration helps enhance macro policy outcomes in light of climate change and economic inequality.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-10-21 10:35:00 Monday ET

American state attorneys general begin bipartisan antitrust investigations into the market power and corporate behavior of central tech titans such as Apple

2018-05-08 13:39:00 Tuesday ET

The Trump administration weighs the pros and cons of a potential mega merger between AT&T and Time Warner. Recent stock prices show favorable trends for

2018-04-05 07:42:00 Thursday ET

CNBC news anchor Becky Quick interviews Berkshire Hathaway's Warren Buffett in light of the recent stock market gyrations and movements. Warren Buffett

2020-06-24 09:32:00 Wednesday ET

Several business founders and entrepreneurs take low risks with high potential rewards to buck the conventional wisdom. Renee Martin and Don Martin (2010

2023-09-07 11:30:00 Thursday ET

Michael Woodford provides the theoretical foundations of monetary policy rules in ever more efficient financial markets. Michael Woodford (2003)

2018-04-23 07:43:00 Monday ET

Harvard professor and former IMF chief economist Kenneth Rogoff advocates that artificial intelligence helps augment human productivity growth in the next d