2018-06-04 08:38:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's tools have become essential to numerous software developers, who use GitHub to store open-source codes and programs with version control on the forum. Microsoft CEO Satya Nadella says the $7.5 billion deal would accelerate a smooth transition to better cloud-computing capacity to add artificial intelligence to current applications such as Office 365 and other Windows apps. Due to its prior open-source nature, the GitHub M&A deal might empower Microsoft to activate the next proliferation of Windows apps in direct competition with Android and iOS apps.

In this fashion, Microsoft can strategically position itself as one of the world's major platform orchestrators to better compete with tech titans such as Google, Amazon, Apple, and Facebook via its hardware-plus-software sales of Surface Pro tablets, Windows smart phones, Office software packages, and other Windows apps. As platform proliferation expands the global user network, Microsoft can integrate both hardware and software products and services to ensure greater customer delight and satisfaction.

Exponential user growth can translate into the multinational corporation's global reach with better bandwidth for future platform-driven mergers and acquisitions. A powerful combination of Trump tax cuts, lower capital costs, robust corporate net gains, and balance sheet capital improvements drive the current appetite for new mergers and acquisitions. In the first half of the current fiscal year, we witness $978 M&A megadeals at a pivotal point in real business cycles with both full employment and low inflation. As many unicorns package themselves as potential M&A targets for tech titans, the current M&A wave boosts the aggregate demand for high-skill R&D patents and tech talents.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-04-05 07:42:00 Thursday ET

CNBC news anchor Becky Quick interviews Berkshire Hathaway's Warren Buffett in light of the recent stock market gyrations and movements. Warren Buffett

2019-04-27 16:41:00 Saturday ET

Tony Robbins suggests that one has to be able to make money during sleep hours in order to reach financial freedom. Most of our jobs and life experiences tr

2017-08-01 09:40:00 Tuesday ET

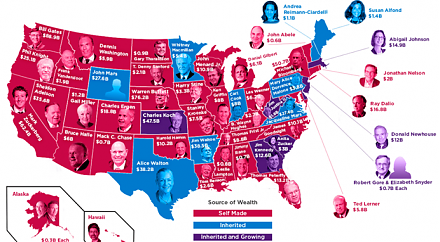

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2018-06-06 09:39:00 Wednesday ET

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bila

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2019-12-04 14:35:00 Wednesday ET

Many billionaires choose to live below their means with frugal habits and lifestyles. Those people who consistently commit to saving more, spending less, an