2018-06-04 08:38:00 Mon ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Microsoft acquires GitHub, a software development platform that has been widely shared-and-used by more than 28 million programmers worldwide. GitHub's tools have become essential to numerous software developers, who use GitHub to store open-source codes and programs with version control on the forum. Microsoft CEO Satya Nadella says the $7.5 billion deal would accelerate a smooth transition to better cloud-computing capacity to add artificial intelligence to current applications such as Office 365 and other Windows apps. Due to its prior open-source nature, the GitHub M&A deal might empower Microsoft to activate the next proliferation of Windows apps in direct competition with Android and iOS apps.

In this fashion, Microsoft can strategically position itself as one of the world's major platform orchestrators to better compete with tech titans such as Google, Amazon, Apple, and Facebook via its hardware-plus-software sales of Surface Pro tablets, Windows smart phones, Office software packages, and other Windows apps. As platform proliferation expands the global user network, Microsoft can integrate both hardware and software products and services to ensure greater customer delight and satisfaction.

Exponential user growth can translate into the multinational corporation's global reach with better bandwidth for future platform-driven mergers and acquisitions. A powerful combination of Trump tax cuts, lower capital costs, robust corporate net gains, and balance sheet capital improvements drive the current appetite for new mergers and acquisitions. In the first half of the current fiscal year, we witness $978 M&A megadeals at a pivotal point in real business cycles with both full employment and low inflation. As many unicorns package themselves as potential M&A targets for tech titans, the current M&A wave boosts the aggregate demand for high-skill R&D patents and tech talents.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-05 08:25:00 Friday ET

Warren Buffett places his $58 billion stock bets on Apple, American Express, and Goldman Sachs. Berkshire Hathaway owns $18 billion equity stakes in America

2020-05-05 09:31:00 Tuesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2023-04-14 13:32:00 Friday ET

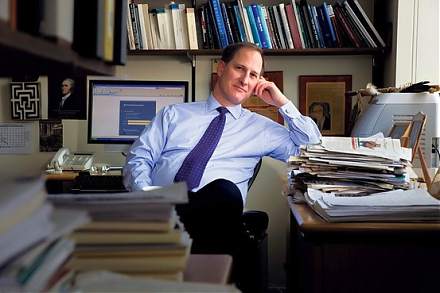

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2017-05-07 06:39:00 Sunday ET

While the original five-factor asset pricing model arises from a quasi-lifetime of top empirical research by Nobel Laureate Eugene Fama and his long-time co

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung