2017-12-09 08:37:00 Sat ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

Michael Bloomberg, former NYC mayor and media entrepreneur, criticizes that the Trump administration's tax reform is a trillion dollar blunder because it adds another $1.5 trillion federal budget deficit to government debt over the next few years. The corporate tax cuts may restrict the U.S. government's ability to invest in education and infrastructure, may render health insurance more expensive, and may have no impact on real wage growth. Harvard public finance professor Martin Feldstein, however, says this tax overhaul is worth its costs because U.S. corporations will use their tax cuts to boost real wages and capex investments, and these firms will repatriate $2.5 trillion offshore cash to invest in job creation, manufacturing automation, and R&D innovation. In line with some economists' op-ed articles and blog posts on the probable effect of the Trump corporate tax cuts on real wage growth, a firm invests up to the point that the after-tax return on its labor and capital investments equates the return that investors require to allow the firm to expand its factor inputs. As the firm receives income tax breaks, it finances the purchase of new machines, plants, and computers. These capital expenditures make the typical worker more productive. Then the firm wants to hire more workers to run the new machines and computers etc. As a result, the typical firm raises real wages until the economy restores its steady state. Hence, tax cuts can effectively boost real wage growth ceteris paribus.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-08-01 09:40:00 Tuesday ET

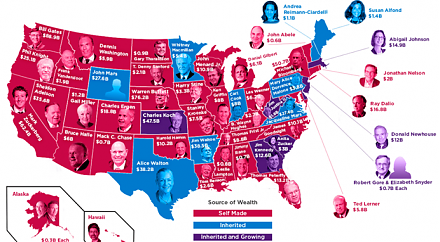

In American states, all of the Top 4 richest people are self-made billionaires: Bill Gates in Washington, Warren Buffett in Nebraska, Michael Bloomberg in N

2019-03-09 12:43:00 Saturday ET

Pinterest files a $12 billion IPO due in mid-2019. This tech unicorn allows users to pin-and-browse images through its social media app and website. Pintere

2019-08-28 14:46:00 Wednesday ET

Santa-Barbara political economy professor Benjamin Cohen proposes new fiscal stimulus to complement the current low-interest-rate monetary policy. Cohen fin

2019-02-15 11:33:00 Friday ET

President Trump is open to extending the March 2019 deadline for raising tariffs on Chinese imports if both sides are close to mutual agreement. These bilat

2020-11-17 08:27:00 Tuesday ET

Management consultants can build sustainable trust-driven client relations through the accelerant curve of business value creation. Alan Weiss (2016)

2025-10-31 12:26:00 Friday ET

With respect to wider weight loss treatment and obesity treatment, the global market for GLP-1 medications now grows substantially to benefit more than 1 bi