2019-08-01 11:33:00 Thu ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Many young and mid-career Americans fall into the financial distress trap in rural communities. A recent analysis of 25,800 zip codes for 99% of the U.S. population compares the consecutive periods from 2007-2011 to 2012-2016. The key reasons for U.S. rural distress include a lack of educational attainment, subpar mortgage affordability, unemployment, low income, and stagnant business investment. Many young Americans experience the catch-22 situation with disproportionate student debt, credit card debt, and mortgage delinquency etc. There is no clear path for these less fortunate young Americans to afford moving from the rural areas to more prosperous metropolitan areas. In the absence of high-skill job opportunities, rural communities remain economically subpar places of residence.

About 65% of the U.S. rural population lives east of the Mississippi River, and half of the rural residents are in the south. Education represents the faulty line between prosperous and economically subpar communities. Specifically, prosperous zip codes contain more than 27 million adults with tertiary education, whereas, there are fewer than 5 million adults with equivalent levels of educational attainment in economically subpar communities from Louisiana, New Mexico, and West Virginia to Alabama, Arkansas, and Mississippi. Economic inequality continues to be a key socioeconomic issue in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-07-23 07:41:00 Monday ET

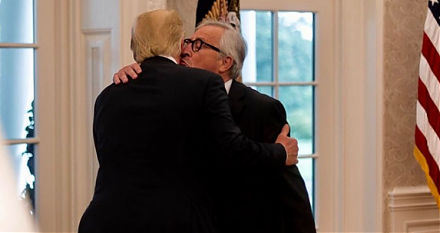

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff

2018-12-01 11:37:00 Saturday ET

As the solo author of the books Millionaire Next Door and Richer Than Millionaire, William Danko shares 3 top secrets for *better wealth creation*. True pro

2018-12-05 09:38:00 Wednesday ET

Federal Reserve publishes its inaugural flagship financial stability report. Fed Chair Jerome Powell applauds both low inflation (2%) and low unemployment (

2018-09-17 12:40:00 Monday ET

Nobel Laureate Robert Shiller's long-term stock market indicator points to a recent peak. His cyclically-adjusted P/E ratio (or CAPE) accounts for long-

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2019-05-15 12:32:00 Wednesday ET

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administ