2017-04-07 15:34:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

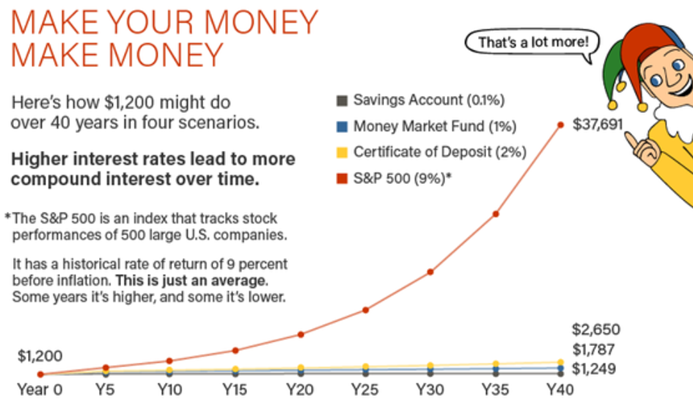

Would you rather receive $1,000 each day for one month or a magic penny that doubles each day over the same month?

At first glance, this counterintuitive question defies the conventional wisdom because compound interest can readily outweigh arithmetic interest over an equivalent time horizon.

Indeed, the magic penny would become $10,737,418, or equivalently 346 times more than $31,000 over the same one-month period.

Successful long-term sustainable value investment focuses on the magic power of compound interest, which Albert Einstein characterizes as the most powerful mathematical tool for exponential growth.

Exponential compound interest is thus the key to unlocking long-run sustainable wealth creation.

Each investor should reinvest his or her disposable income from cash dividend payout and share buyback to yield interest on both principal and interest income.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-03 09:31:00 Monday ET

Amazon follows Apple to become the second American public corporation to hit $1 trillion stock market valuation. Amazon's founder and chairman Jeff Bezo

2020-07-19 09:25:00 Sunday ET

Senior business leaders can learn much from the lean production system with iterative continuous improvements at Toyota. Takehiko Harada (2015)

2019-06-29 17:30:00 Saturday ET

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, socia

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2017-12-07 08:31:00 Thursday ET

Large multinational tech firms such as Facebook, Apple, Microsoft, Google, and Amazon can benefit much from the G.O.P. tax reform. A recent stock research r

2018-08-01 11:43:00 Wednesday ET

Apple becomes the first company to hit $1 trillion stock market valuation. The tech titan sells about the same number of smart phones or 41 million iPhones