2019-11-01 12:31:00 Fri ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

Kourtney Kardashian shares the best money advice from her father. This advice reminds her that money just cannot buy happiness. As the eldest of the Kardashian clan, Kourtney Kardashian has 3 children and personal net worth of $35 million on Money.com. She has almost 82 million followers on Instagram.

Kourtney Kardashian is not the richest of the Kardashian empire, which includes Kris Jenner, Kim Kardashian West, Khloe Kardashian, and Kylie Jenner. In terms of personal wealth, Kylie Jenner tops the Kardashian clan and is now the youngest self-made billionaire.

Kourtney Kardashian runs her latest business venture Poosh as an online health and wellness website. She keeps the long-term consensus view that new business ventures sometimes can take a bit longer to return cash flows in accordance with most generic expectations.

In the modern age of digital technology proliferation, people have a short attention span and often prefer immediate gratification and the early resolution of uncertainty. Kourtney Kardashian further shares the personal finance tip that people should be more conscious of day-to-day expenses by retaining small increments of cash as emergency funds. People should learn to delay gratification and early harvest to reap rewards over the longer run. Patience pays well in time.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-07 07:33:00 Friday ET

The Economist re-evaluates the realistic scenario that the world has learned few lessons of the global financial crisis from 2008 to 2009 over the past deca

2018-06-25 12:43:00 Monday ET

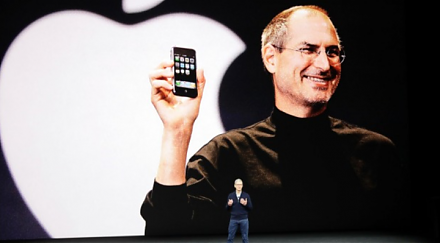

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2025-04-30 08:27:00 Wednesday ET

The multiple layers of the world cloud Internet help expand what can be made digitally viable from electric vehicles (EV) and virtual reality (VR) headsets

2018-01-01 06:30:00 Monday ET

As former chairman of the British Financial Services Authority and former director of the London School of Economics, Howard Davies shares his ingenious ins

2026-07-01 11:29:00 Wednesday ET

In recent years, higher American economic growth has been impressive both by historical standards and in comparison to the rest of the world. American excep

2018-12-03 10:40:00 Monday ET

Bank of England publishes its latest insights into the economic impact of Brexit on British real productivity, capital investment, and labor supply as of 20