2018-06-05 07:36:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Just Capital issues a new report in support of the stakeholder value proposition in recent times. U.S. corporations that perform best on key priorities such as worker treatment, fair pay, ethical leadership, and environmental protection both generate significantly higher investment returns and exhibit lower return volatility than the subpar performers. Specifically, the top 20% U.S. corporations attain a higher 14% average annual stock return and 7% lower return volatility in contrast to the bottom 20% U.S. corporations. Also, a composite stock investment portfolio strategy that involves both a long position in the former and a short position in the latter yields a hefty 10.6% annual Fama-French factor alpha on average.

Therefore, the stock market rewards those companies that focus on achieving top priorities in support of stakeholder value optimization (in addition to shareholder wealth maximization). Overall, each wise stock market investor should look beyond both fundamental and technical indicators of corporate financial health in the hot pursuit of better employment treatment, equal pay, environmental sustainability, and ethical leadership. These broader considerations help deepen each wide stock market investor's smart data analysis of both quantitative and qualitative insights and perspectives through the lens of long-term sustainable business enterprises.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2022-02-22 09:30:00 Tuesday ET

The global asset management industry is central to modern capitalism. Mutual funds, pension funds, sovereign wealth funds, endowment trusts, and asset ma

2019-07-27 17:37:00 Saturday ET

Capital gravitates toward key profitable mutual funds until the marginal asset return equilibrates near the core stock market benchmark. As Stanford finance

2018-12-17 08:43:00 Monday ET

Apple files an appeal to overturn the recent iPhone sales ban in China due to its patent infringement of Qualcomm proprietary technology. This recent ban of

2025-07-05 11:23:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why working with emotional intelligence helps hone our social skills f

2019-01-21 10:37:00 Monday ET

Andy Yeh Alpha (AYA) AYA Analytica financial health memo (FHM) podcast channel on YouTube January 2019 In this podcast, we discuss several topical issues

2018-07-25 11:41:00 Wednesday ET

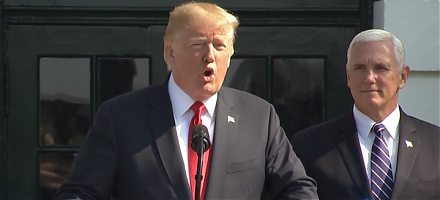

President Trump hails and touts America's new high real GDP economic growth in 2018Q2. The U.S. is now a $20+ trillion economy, and America hits this mi