2018-06-05 07:36:00 Tue ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

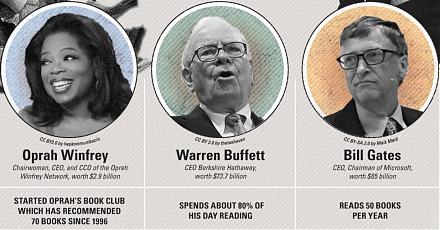

Just Capital issues a new report in support of the stakeholder value proposition in recent times. U.S. corporations that perform best on key priorities such as worker treatment, fair pay, ethical leadership, and environmental protection both generate significantly higher investment returns and exhibit lower return volatility than the subpar performers. Specifically, the top 20% U.S. corporations attain a higher 14% average annual stock return and 7% lower return volatility in contrast to the bottom 20% U.S. corporations. Also, a composite stock investment portfolio strategy that involves both a long position in the former and a short position in the latter yields a hefty 10.6% annual Fama-French factor alpha on average.

Therefore, the stock market rewards those companies that focus on achieving top priorities in support of stakeholder value optimization (in addition to shareholder wealth maximization). Overall, each wise stock market investor should look beyond both fundamental and technical indicators of corporate financial health in the hot pursuit of better employment treatment, equal pay, environmental sustainability, and ethical leadership. These broader considerations help deepen each wide stock market investor's smart data analysis of both quantitative and qualitative insights and perspectives through the lens of long-term sustainable business enterprises.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-09-15 11:35:00 Saturday ET

Apple releases its September 2018 trifecta of smart phones or iPhone X sequels: iPhone Xs, iPhone Xs Max, and iPhone XR. Both iPhone Xs and iPhone Xs Max ha

2018-03-01 07:35:00 Thursday ET

Trump imposes high tariffs on steel (25%) and aluminum (10%) in a new trade war with subsequent exemptions for Canada and Mexico. The Trump administration&#

2023-11-21 11:32:00 Tuesday ET

Nobel Laureate Paul Milgrom explains the U.S. incentive auction of wireless spectrum allocation from TV broadcasters to telecoms. Paul Milgrom (2019)

2018-10-11 08:44:00 Thursday ET

Treasury bond yield curve inversion often signals the next economic recession in America. In fact, U.S. bond yield curve inversion correctly predicts the da

2018-05-08 13:39:00 Tuesday ET

The Trump administration weighs the pros and cons of a potential mega merger between AT&T and Time Warner. Recent stock prices show favorable trends for

2022-02-02 10:33:00 Wednesday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O