2019-12-19 14:43:00 Thu ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

JPMorgan Chase CEO Jamie Dimon views wealth inequality as a major economic problem in America. Dimon now warns that the rich Americans have been getting wealthier too much in many ways. In contrast, Dimon further observes that middle-class income remains flat for 15-20 years. This stark economic divergence cannot be particularly good in America.

Some demographic changes may be the root cause of both wealth inequality and a rare lack of trade-off between inflation and unemployment in America. The latter has profound public policy implications for the Federal Reserve and Treasury in terms of dovish interest rate adjustments with better fiscal prudence. The Sargent-Wallace monetarist arithmetic analysis shows that the monetary authority cannot contain inflation with maximum sustainable employment and price stability when the government continues to issue public bonds to fund incessant fiscal deficits on top of national debt mountains. The Dimon remarks emerge amid many criticisms of the top U.S. income cohort by Democratic Senator Elizabeth Warren, Former Vice President Joe Biden, and Former New York City Mayor Michael Bloomberg. Dimon further suggests that both income and wealth inequality may inadvertently widen disparities in socioeconomic opportunities from education and health care to employment and technology.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-03-23 08:26:00 Friday ET

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai

2023-12-10 09:23:00 Sunday ET

U.S. federalism and domestic institutional arrangements A given country is federal when both of its national and sub-national governments exercise separa

2023-03-14 16:43:00 Tuesday ET

Several feasible near-term reforms can substantially narrow the scope for global tax avoidance by closing information loopholes. Thomas Pogge and Krishen

2017-08-07 09:39:00 Monday ET

Global financial markets suffer as President Trump promises *fire and fury* in response to the recent report that North Korea has successfully miniaturized

2025-03-03 04:11:06 Monday ET

Is higher stock market concentration good or bad for Corporate America? In recent years, S&P 500 stock market returns exhibit spectacular concentrati

2018-10-17 12:33:00 Wednesday ET

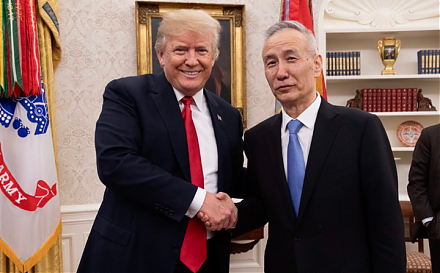

The Trump administration blames China for egregious currency misalignment, but this criticism cannot confirm *currency manipulation* on the part of the Chin