2019-12-19 14:43:00 Thu ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

JPMorgan Chase CEO Jamie Dimon views wealth inequality as a major economic problem in America. Dimon now warns that the rich Americans have been getting wealthier too much in many ways. In contrast, Dimon further observes that middle-class income remains flat for 15-20 years. This stark economic divergence cannot be particularly good in America.

Some demographic changes may be the root cause of both wealth inequality and a rare lack of trade-off between inflation and unemployment in America. The latter has profound public policy implications for the Federal Reserve and Treasury in terms of dovish interest rate adjustments with better fiscal prudence. The Sargent-Wallace monetarist arithmetic analysis shows that the monetary authority cannot contain inflation with maximum sustainable employment and price stability when the government continues to issue public bonds to fund incessant fiscal deficits on top of national debt mountains. The Dimon remarks emerge amid many criticisms of the top U.S. income cohort by Democratic Senator Elizabeth Warren, Former Vice President Joe Biden, and Former New York City Mayor Michael Bloomberg. Dimon further suggests that both income and wealth inequality may inadvertently widen disparities in socioeconomic opportunities from education and health care to employment and technology.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-02-03 13:39:00 Sunday ET

It can be practical for the U.S. to impose the 2% wealth tax on the rich. Democratic Senator Elizabeth Warren proposes a 2% wealth tax on the richest Americ

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies

2018-11-09 11:35:00 Friday ET

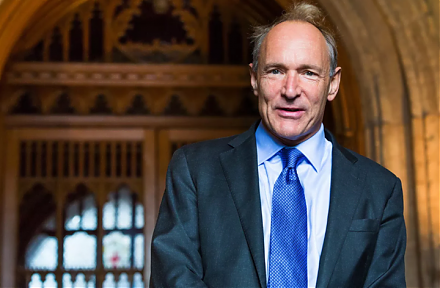

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2018-12-11 10:34:06 Tuesday ET

Several eminent American China-specialists champion the key notion of *strategic engagement* with the Xi administration. From the Hoover Institution at Stan

2025-09-24 09:49:53 Wednesday ET

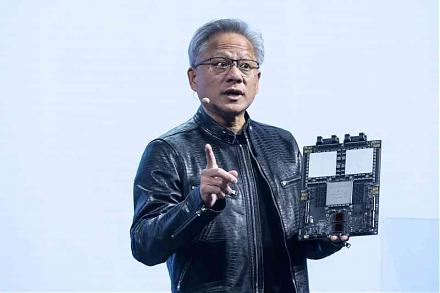

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-11-06 12:29:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.