2019-02-03 13:39:00 Sun ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

It can be practical for the U.S. to impose the 2% wealth tax on the rich. Democratic Senator Elizabeth Warren proposes a 2% wealth tax on the richest Americans with more than $50 million in total assets. For the even richer Americans with more than $1 billion total assets, the wealth tax should rise to 3%. This radical tax proposal may help raise almost $2.5 trillion to $3 trillion in a decade, although this proposal affects less than 0.1% of U.S. households in accordance with the fiscal estimates of Berkeley economic advisor Emmanuel Saez. On one hand, this wealth tax can help reduce economic inequality in America by closing the wealth gap between the rich and the middle class. At the same time, this wealth redistribution can promote better social mobility as the rich Americans may then find it difficult to transfer their economic advantages to the next generation via education, business ownership, and political power.

On the other hand, the wealth tax proposal can help fight tax evasion by wealthy Americans who might choose to renounce their U.S. citizenship by tunneling funds abroad. The proposal is now subject open debate and controversy as the American consensus tilts toward progressive taxation.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-07-14 10:32:00 Friday ET

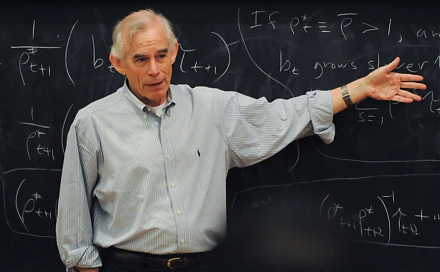

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2019-01-15 13:35:00 Tuesday ET

Americans continue to keep their financial New Year resolutions. First, Americans should save more money. Everyone needs a budget to ensure that key paychec

2023-12-04 12:30:00 Monday ET

Bank leverage and capital bias adjustment through the macroeconomic cycle Abstract We assess the quantitative effects of the recent proposal

2019-06-23 08:30:00 Sunday ET

The financial crisis of 2008-2009 affects many millennials as they bear the primary costs of college tuition, residential demand, health care, and childcare

2018-09-07 07:33:00 Friday ET

The Economist re-evaluates the realistic scenario that the world has learned few lessons of the global financial crisis from 2008 to 2009 over the past deca